The primary aim of the MI Hawksmoor Global Opportunities Fund is to deliver returns, after charges, in excess of general markets over the long term (defined as rolling periods of at least 5 years).

How do we achieve this?

We will invest in a variety of financial assets which can be volatile.

What is the yield target?

There is no yield target, and because the aim of the Fund is to grow capital, income generation is minimal.

What are the asset exposure parameters?

The Fund sits in the Investment Association Flexible Investment Sector, giving the managers maximum flexibility over asset allocation, including equities, bonds, property and commodities, and over a range of geographical regions. The portfolio has a minimum exposure to equities of 60%.

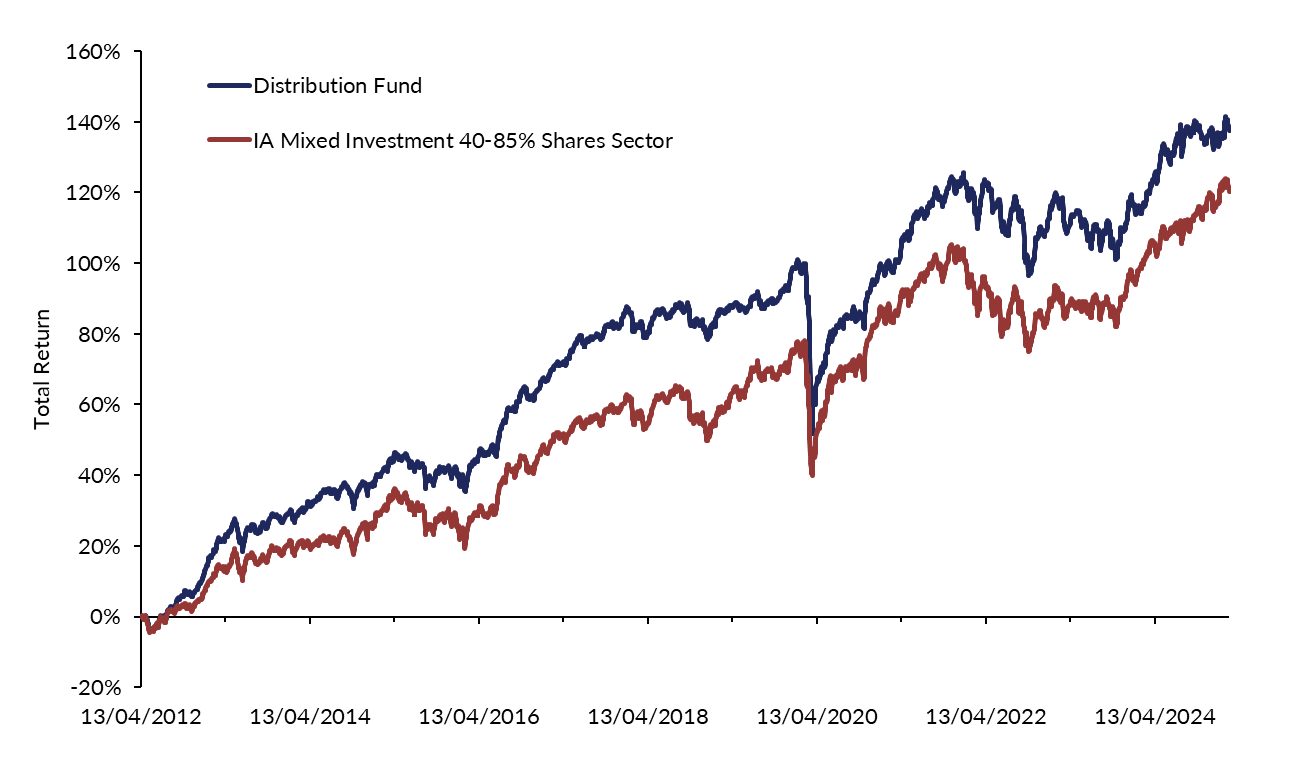

How has the Fund performed since launch?

Source: FE fundinfo. 13/09/2018 to 28/02/2025. GBP total return, C Acc units. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise. You may not get back the amount you originally invested.

Where can I find the current price?

For an up-to-date price of the Global Opportunities Fund, click this link to our administration provider Apex Fundrock.

How do I invest?

You can invest in the Global Opportunities Fund via your chosen investment platform, or you can invest directly (with a minimum investment of £5,000) by downloading and completing the Funds Application Form below.