The MI Hawksmoor Distribution Fund is designed to have broad appeal, and to be a core long-term investment for those seeking actively managed exposure to financial markets with income as a priority. The primary aim of the Fund is to deliver an attractive level of income, whilst also delivering capital growth over the medium to long term (defined as rolling periods of 3-5 years).

How do we achieve this?

In striving to achieve these targets, we will invest in a variety of financial assets which can be volatile. We will seek to mitigate this volatility by ensuring a diversified portfolio of assets, each of which shares the common characteristics of a margin of safety and low intra-asset correlations.

What is the yield target?

We aim to ensure the Fund’s yield will always be at a premium to a composite index of financial asset classes (equities, bonds, property and cash). The intention is to increase the distribution alongside an increase in capital growth in order to maintain an attractive distribution yield for new and existing investors.

What are the asset exposure parameters?

As a constituent of the Investment Association’s Mixed Investment 40-85% Shares Sector, the Fund will at all times have a minimum of 40% and a maximum of 85% in equities.

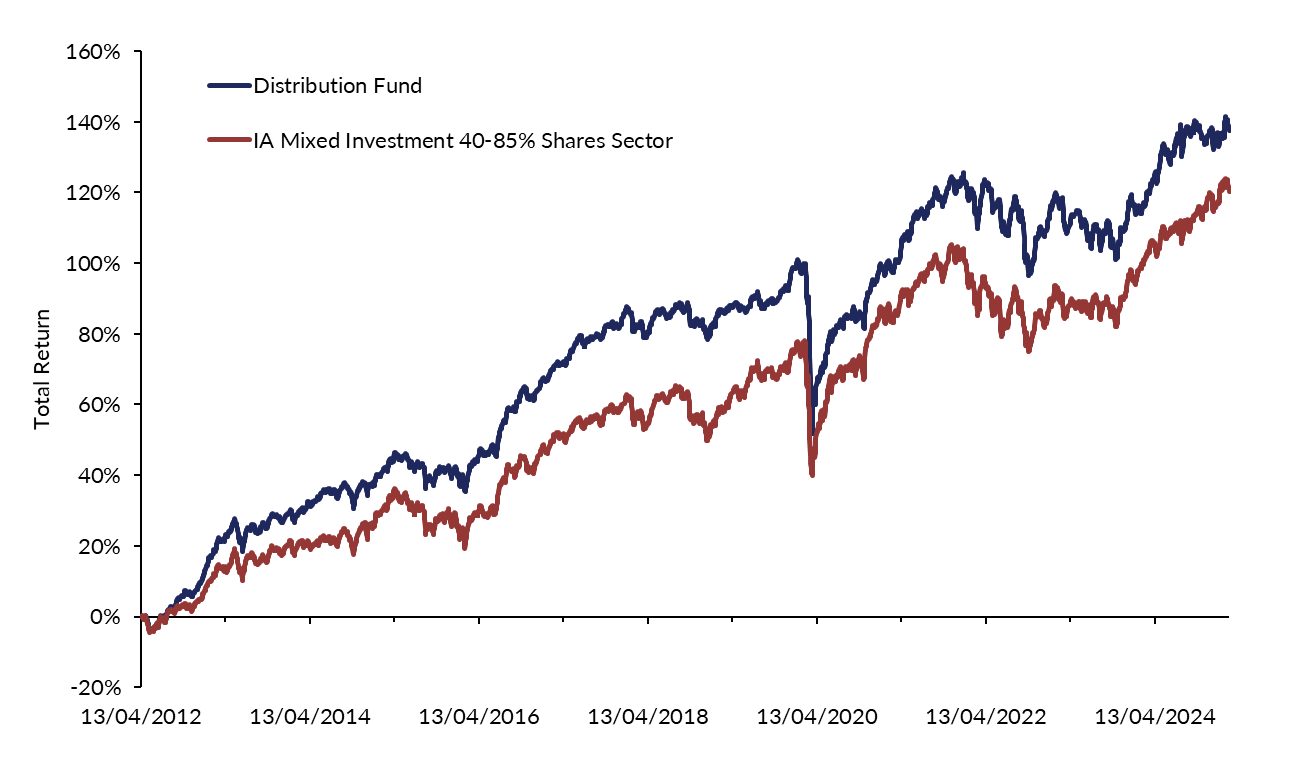

How has the Fund performed since launch?

The Distribution Fund – rewarding long term investors

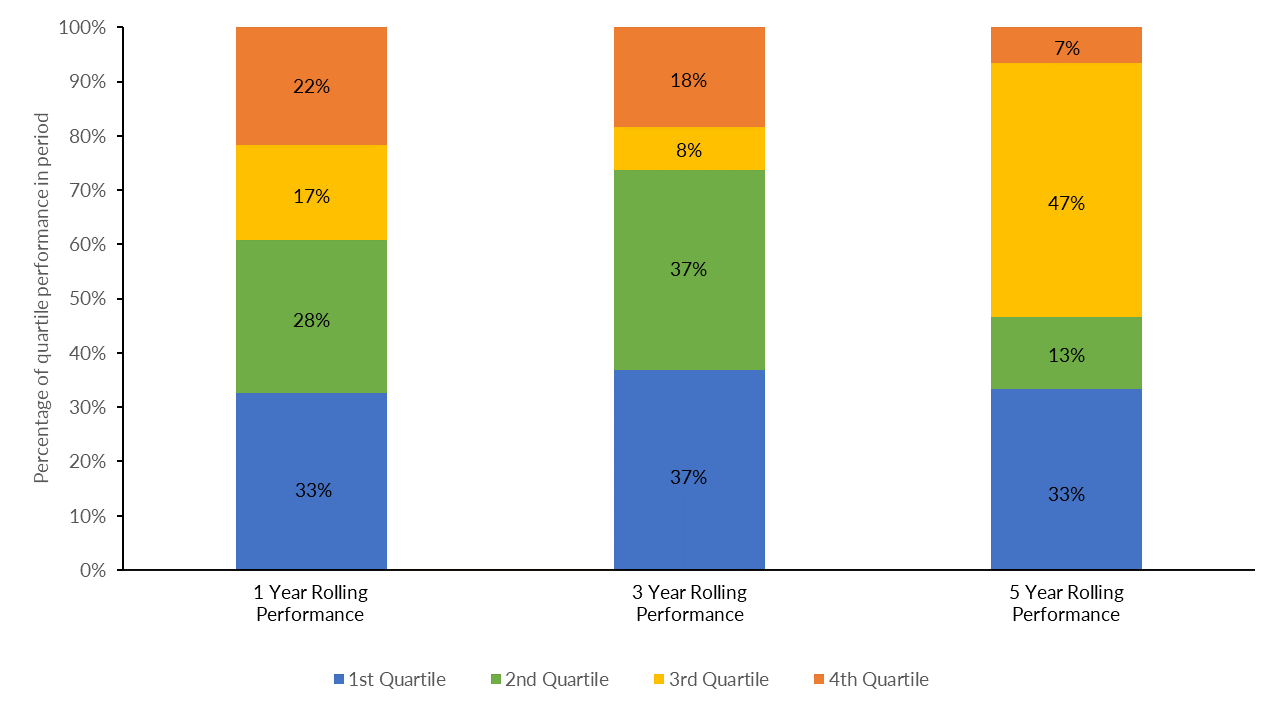

The chart below shows the percentage of times, looking back through history, that the Distribution Fund’s rolling 1, 3 and 5 year performance has been in the 1st (top), 2nd, 3rd or 4th (bottom) quartile relative to its sector, the IA Mixed Investment 40-85% Shares Sector. Rolling periods begin at each quarter end since Distribution’s launch, starting from the 30/06/2012.

Where can I find the current price?

For an up-to-date price of the Distribution Fund, click this link to our administration provider Apex Fundrock.

How do I invest?