Launched in April 2012, the MI Hawksmoor Distribution Fund’s primary aim is to deliver an attractive level of income, whilst also delivering capital growth over the medium to long term (defined as rolling periods of 3-5 years). The Fund is designed to have broad appeal and to be a core long-term investment for any of your clients who are looking for actively managed exposure to financial markets with income as a priority.

In doing this, we will aim to ensure the Fund’s yield will always be at a premium to a composite index of financial asset classes (equities, bonds, property and cash). The intention is to increase the distribution alongside an increase in capital growth in order to maintain an attractive distribution yield for new and existing investors.

In striving to achieve these targets, we will invest in a variety of financial assets which can be volatile. We will seek to mitigate this volatility by ensuring a diversified portfolio of assets, each of which shares the common characteristics of a margin of safety and low intra-asset correlations.

As a constituent of the Investment Association’s Mixed Investment 40-85% Shares Sector, the Fund will at all times have a minimum of 40% and a maximum of 85% in equities.

For an up-to-date price of the Distribution Fund, click this link to our administration provider Apex Fundrock.

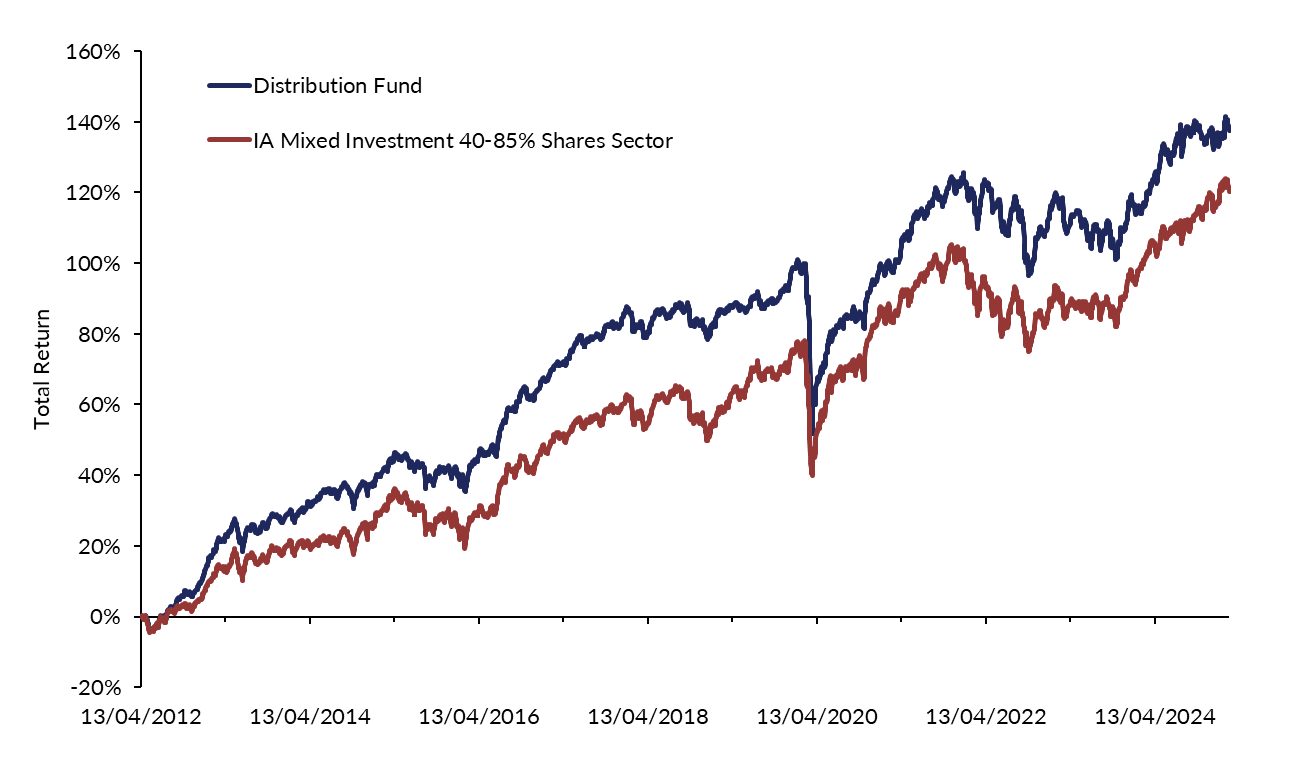

Fund performance since launch:

Source: FE fundinfo. 13/04/2012 to 28/02/2025. GBP total return, C Acc units (performance history extended where required). Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise. You may not get back the amount you originally invested.

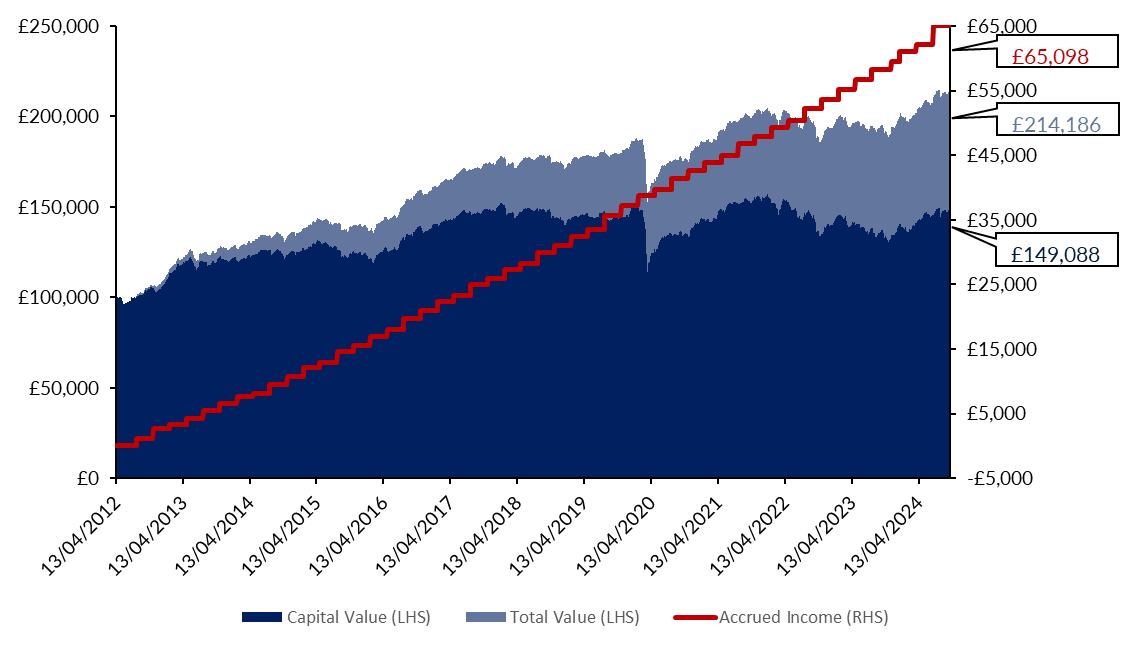

The Income Experience

If you had invested £100,000 at launch on 13th April 2012, you would have received £62,130 in income (red line) and the capital would be worth £145,082 (dark blue area), giving you a total value of £207,212 (light blue area). If you had reinvested all income, then the capital would be worth £229,946.

Source: FE fundinfo, 13/04/2012 to 30/09/2024. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise. You may not get back the amount you originally invested.