Hawksmoor Investment Management Limited is authorised & regulated by the Financial Conduct Authority Incorporated in England & Wales Company Number 6307442

This Document describes Hawksmoor Investment Management’s (HIM’s) Responsibilities for, and approach to:

(1) Consumer Duty

(2) Handling Complaints

(3) Best Execution Policy

(4) Protection of Client Monies and Assets

(5) Conflicts of Interest

(6) MiFIDPRU 8 Disclosure

1. Consumer Duty

At Hawksmoor we are dedicated to upholding the standards of the FCA’s Consumer Duty. This regulatory framework is designed to ensure firms deliver good outcomes for retail customers by prioritising their best interests, mitigating foreseeable harm, and fostering informed decision-making. The Consumer Duty emphasises four key outcomes that firms must deliver:

- Products and Services – Ensuring products and services are designed to meet the needs, characteristics, and objectives of specific consumer groups, providing fair value.

- Price and Value – Offering fair value by ensuring that the price paid for products and services is proportionate to the benefits received.

- Consumer Understanding – Communicating with clarity and transparency, enabling customers to make informed decisions.

- Consumer Support – Providing responsive, accessible, and ongoing support throughout the customer relationship.

We are committed to embedding these principles within our operations, ensuring our clients benefit from transparency, fair treatment, and support.

2. Handling Complaints

We hope you won’t have cause to complain, but if you are unhappy with something we have, or haven’t, done then please tell us. By letting us know you are unhappy you give us the opportunity to put matters right for you and to improve our services for everyone.

In the first instance you should contact your Investment Manager using their usual contact details. Should you remain dissatisfied or wish to raise your complaint with someone independent to your Investment Manager then please contact our Compliance Team who can be reached by emailing [email protected]. or alternatively at our Exeter office:

The Compliance Officer

Hawksmoor Investment Management Ltd.

17 Dix’s Field

Exeter

Devon

EX1 1QA

Telephone: 01392 410810 or Email: [email protected]

Or in person at our offices (please see our Contact Us page for directions).

Whichever way you choose to contact us please be assured that we will:

- provide you with a summary of our internal complaints process when we write to acknowledge your complaint or if you request one from us;

- contact you promptly to let you know that we are looking into your concerns and give you an indication of when you can expect to hear from us again;

- keep you regularly updated and, if it looks like our investigation may take more than eight weeks from when you first contacted us, we will write to you with an update;

- look into your complaint thoroughly and, once our investigations are complete, we will send you a final written response setting out what we have found and what our decision is / what we propose to do; and,

- inform you of your right to refer the matter to the Financial Ombudsman Service.

Sometimes a concern may not be about one of our regulated activities. If that is the case, we will still treat your complaint seriously and investigate it promptly and tell you what the outcome is within a reasonable period of time.

3. Best Execution

Introduction

It is in the interests of our clients and of Hawksmoor Investment Management Ltd (HIM) that we obtain the best possible result when placing orders with other firms (for example, third party brokers) when executing client orders or transmitting orders on behalf of clients. The Financial Conduct Authority (FCA) requires HIM to take sufficient steps to obtain best execution when carrying out transactions. This section sets out our policy for achieving “best execution” when acting for our clients. We will provide our clients with a copy of this policy, if they request one from us.

This policy does not apply to collective investments – providers of Unit Trusts and Open Ended Investment Companies (OEICs) value and price funds in accordance with the FCA requirements set out in its Collective Investment Schemes (COLL) handbook.

Best Execution

When placing orders on our clients’ behalf, or when dealing in the course of managing their portfolios, we take all necessary steps to obtain the best result for them on a consistent basis. What this means is that we will take into account the following factors:

- price

- cost(s)

- speed

- method and/or likelihood of execution and settlement

- size or nature of the trade

- any other relevant consideration.

For our ‘retail clients’, price and cost will normally be the most important considerations in obtaining the best possible result. HIM will assume this is the case unless the client tells us otherwise.

For our ‘professional clients’ HIM may focus on factors other than price or cost. These may vary from client to client and depend on the nature of the service we have agreed.

Executing Orders – Discretionary and Execution Only Services

BNY Pershing Securities Ltd (BNY Pershing) provide trade execution services to HIM as well as custody and settlement, since HIM is not authorised to hold clients’ assets nor is it a member firm of the London Stock Exchange (LSE).

The trades we initiate through BNY Pershing are carried to the market in the name of BNY Pershing. Hawksmoor will refer trades direct to BNY Pershing’s dealers. They will then investigate the market and execute at the best possible available.

For sales and purchases that are for securities quoted outside the United Kingdom, or are complex, or are above normal market size, the custodian will use its discretion in placing the trade. The execution venue it will use will depend on the exact nature of the trade, but will typically be executed through one of the following market makers.

| Cantor Fitzgerald | Novum |

| Cannacord | Numis |

| Cenkos | Oriel |

| Davy | Panmure |

| Fox-Davies | Peel Hunt |

| FinnCap | Shore Capital |

| Investec Securities | SIG (Susquehanna) |

| J.P.Morgan | N+1 Singer Capital Markets |

| Jefferies | Westhouse |

| Knight | WH Ireland |

| Liberum | Winterflood Securities |

| Lloyds |

These market makers have been selected according to the criteria outlined above.

The majority of the trades for private client portfolios are in open-ended funds, where issues of best execution do not arise.

Executing Orders – Vanbrugh, Distribution, Global Opportunities and Redlands Funds

In the case of the Vanbrugh, Distribution and Global Opportunities Funds, HIM has been appointed by the Authorised Corporate Director (ACD), Apex Fundrock, to act as the investment manager.

Transactions in market securities are traded via ‘Approved Brokers’, who provide best execution and trade and transaction reporting. A list of our current ‘Approved Brokers’ is:

| Arbuthnot | J.P.Morgan |

| Canaccord | Liberum |

| Cantor Fitzgerald | Matrix |

| Cazenove | Numis |

| Cenkos | Panmure Gordon |

| Collins Stewart | Peel Hunt |

| Fidante | N +1 Singer Capital Markets |

| Investec Securities | Stifel |

| Intelli | Stockdale |

| Jefferies | Winterflood Securities |

The majority of the trades for the Funds’ portfolios are in open-ended funds, where issues of best execution do not arise.

Executing Orders – Discovery Funds and ETFs for the Redlands Funds

For the Discovery Funds and for ETF transactions for the Redlands Funds, trade execution is outsourced to Valu-Trac Investment Management Limited (“Valu-Trac”), who are also the ACD, Administrator and Registrar of these funds.

Specific Instructions

If a client has given instructions that price is not the most important factor in executing their instructions, HIM will make every effort to comply with the instructions but cannot guarantee this. This may be due to either the nature of the order, or the type of financial instrument the client wishes to trade in.

Depending on the nature of our agreement with the client, HIM will either:

- make all decisions as to where the orders are placed in relation to the execution venue; or,

- accept specific instructions from the client regarding the venue where the order is executed.

Third Parties

Where we use third parties, for example approved brokers, we will ensure that our Terms and Conditions with them provide that they will make all reasonable efforts to provide best execution when we instruct transactions through them.

Conflicts of interest

Please refer to section 5 for further information.

Monitoring and Reviewing our Best Execution Arrangements

HIM has in place systems and controls to ensure that we obtain the best possible results for our clients when executing orders. These are monitored periodically. Our execution policy and arrangements are reviewed whenever there is a significant change affecting our ability to continue to obtain the best possible results for our clients and at least on an annual basis.

For the Hawksmoor and Redlands Funds, we record the details of each trade and calculate the performance of each transaction, by comparing the execution price to a benchmark price. The benchmark price is defined as the bid or offer price dependent on the direction of the transaction at the time that the deal was instructed by the fund manager to the broker. For example, if it is a purchase then the benchmark price is the offer price, and if it is a sale then the benchmark price if the bid price.

For the Discovery Funds and ETF transactions for the Redlands funds, a monthly statement is received from Valu-Trac showing the performance of each individual transaction, by comparing the execution price to a benchmark price. The benchmark price is defined as interval VWAP (the interval being the time between the time the order was instructed and the time the order was completed). Where an interval VWAP is not provided (due to the transaction being completed “off book” in a single fill) the full day VWAP will be used as the benchmark price.

All relevant employees are made aware of our policy and understand the importance of best execution.

4. Protection of Client Monies & Assets

Hawksmoor Investment Management Ltd. (HIM’s) bespoke private client discretionary portfolio management services are provided to our clients through ‘Model B Agreements’ under which HIM arranges for the custody and settlement of the holdings in a client’s portfolio to be provided by a specialist third party provider (“the Custodian”), which itself is authorised and regulated by the Financial Conduct Authority.

Under the Model B Agreement, the Custodian provides clearing and settlement, safe custody, nominee and associated services for those clients of ours who we may introduce to it. The Custodian may also provide additional services as we may agree with it from time to time.

The current terms and conditions of the Custodian and the principal terms of the Model B Agreement with it as applicable to our clients (“the Agreement”) are contained in HIM’s Client Account Guide. The Custodian may amend the terms and conditions of the Agreement from time to time by notice in writing to us.

By acceptance of the terms of the Agreement, our client agrees that:

a. HIM is authorised to enter into the Agreement on our client’s behalf as our client’s agent;

b. acceptance of the terms of the Agreement will constitute the formation of a contract between our client and ourselves and also between our client and the Custodian and that our client will be bound by the terms of the Agreement and the terms and conditions of the Custodian (summarised below) accordingly;

c. we are authorised to give instructions (as provided for in the terms of the Agreement) and provide information concerning our clients to the Custodian and the Custodian shall be entitled to rely on any such instructions or information without further enquiry;

d. the Custodian is authorised to hold cash and investments on our client’s behalf and is authorised to transfer cash or investments from our client’s account to meet our client’s settlement or other obligations to the Custodian.

Under the Agreement our client will remain a customer of ours but will also become a client of the Custodian for settlement and safe custody purposes only. HIM retains responsibility for compliance and regulatory requirements regarding our own operations, for the supervision and operation of our client’s account and generally for our relationship with our client. In particular, it remains responsible for approving the opening of accounts, money laundering compliance and the accepting and executing of orders in investments. The Custodian is not responsible to our client for those matters and, in particular, neither provides investment advice nor gives advice or offers any opinion regarding the suitability or appropriateness (as appropriate) of any transaction or order.

HIM may control, but is not permitted to hold, client monies or assets.

5. Conflicts of Interest

The FCA requires HIM to take all reasonable steps to identify any conflicts of interest between our firm/an employee/any associate of our firm, and any of our clients or conflicts of interest between one client and another. A conflict of interest is a situation where HIM or its employees or associates have competing interests which may prevent services being provided to clients in an independent or impartial manner.

HIM recognises that, in the course of its business, there are circumstances which may give rise to unavoidable conflicts of interest. This section summarises the primary circumstances where conflicts may arise and sets out the specific measures that HIM employs to manage, or remove, these actual or potential conflicts of interest.

Policies and Procedures

HIM has policies and procedures that it has embedded throughout our business to ensure that conflicts are identified, considered, mitigated and either managed or removed altogether.

HIM’s members of staff undergo regular training and are provided with guidance when a conflict situation arises. HIM’s management team is responsible for ensuring that the risks within their business areas are identified and managed appropriately.

Supervision

Where the interests of one HIM team and its clients may conflict with another team and its clients, the management structure is separated.

Remuneration

HIM has a remuneration policy in place. Please see the MiFIDPRU 8 Disclosure for further information.

Best execution

HIM has best execution arrangements in place. Please see section 3 for further information.

Dealing as principal

HIM does not hold principal positions in securities, nor do we deal on our own account.

Investment Research

HIM pays for investment research through our own financial resources and not through the use of dealing commissions.

Outside business interests

All employees are required to disclose outside business interests and directorships when they join HIM and are reminded of their continuing obligation to disclose them on a regular basis.

Personal account dealing

HIM has a policy that controls personal account dealing undertaken by our employees, including on their partners’ and dependents’ accounts. HIM’s investment staff may themselves maintain investments in HIM’s managed fund of funds, The Vanbrugh, Distribution and Global Opportunities Funds, and in other securities included within our discretionary portfolios. Where this is the case, HIM discloses this via our marketing and promotional material.

Gifts and inducements

HIM has a policy and procedure in place for the giving and receiving of gifts and hospitality. Employees must not solicit nor accept any inducement which may conflict with the duty we owe to our clients, nor offer inducements which may conflict with the recipient’s duty to its own clients.

Employees may, from time to time, receive non-monetary benefits, or gifts, from clients, providers or other third parties. Any such benefits are typically of a modest nature and relate to provision of literature, participation in seminars training and hospitality.

All gifts and non monetary benefits, unless of a token kind, require prior approval and are recorded in our register.

Aggregation and allocation

To ensure that deals cannot be allocated in favour of one group of clients or staff, HIM operates an aggregation and allocation procedure covering both our discretionary portfolio services and our managed funds of funds.

Funds

For portfolios under our discretionary services we will always only purchase the institutional or ‘clean’ units or share classes of open-ended funds which do not pay commissions.

Where a client transfers into their portfolio older style units or share classes of an open-ended fund which pay a commission, we will seek to transfer them into an institutional or ‘clean’ unit or share class at the earliest practical opportunity.

In addition to our Discretionary Portfolio Management Service, HIM offers an alternative discretionary service – the Capstone Service – which contains ‘core’ holdings in one of our managed funds-of-funds, the Vanbrugh, Distribution and Global Opportunities Funds. The conflict in the use of our own managed funds in a discretionary service is mitigated by:

(a) the choice of service being entirely the client’s, who is provided with clear Guides and Schedules of Charges for both Services and

(b) the annual management fee for the Capstone Service not being applied to the element of the overall portfolio in the HIM-managed funds.

6. MiFIDPRU 8 Disclosure

Introduction

This disclosure is in relation to Hawksmoor Investment Management Ltd (“HIM” or “the Firm”). The Firm is incorporated in the United Kingdom (“UK”) (Company Number: 6307442) and is authorised and regulated by the Financial Conduct Authority (“FCA”) under firm reference number 472929.

This document sets out the public disclosure under MIFIDPRU 8 for the Firm as of 31 December 2023, which represents the end of the Firm’s most recent financial accounting period.

HIM provides discretionary investment management services and specialises in managing private client portfolios, as well as multi-asset funds-of-funds and a series of risk-based ‘Model Portfolios’ for Financial Advisers.

As a UK investment firm undertaking activities within the scope of the UK Markets in Financial Instruments Directive (“MIFID”), HIM is subject to the prudential requirements of the Investment Firms Prudential Regime (“IFPR”) contained in the MIFIDPRU Prudential sourcebook for MIFID Investment Firms of the FCA Handbook.

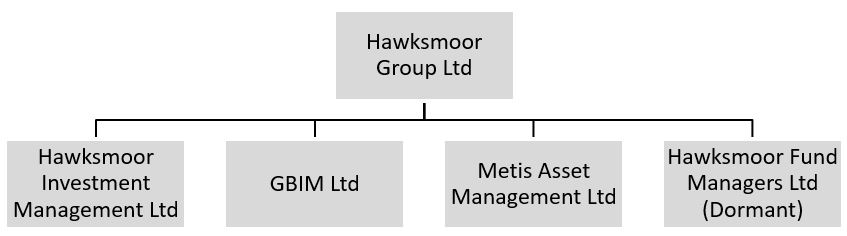

The firm is part of the Hawksmoor Group Limited (“Hawksmoor Group” or “the Group” or “HGL”), which is classified as a MIFIDPRU investment firm group as per MIFIDPRU 2.4.2. HGL is wholly a wholly owned subsidiary of Hurst Point Group Limited. The definition of an investment firm group covers a parent undertaking that is incorporated in the UK or has its principal place of business in the UK, and its subsidiaries, at least one of which must be a MIFIDPRU investment firm. Under the IFPR’s categorisation, HGL is categorised as a non-small, non- interconnected (“non-SNI”) MIFIDPRU investment firm group. The ICARA process is run on a group basis but with each entity within the Group approving their separate Own Funds and Liquid Asset Threshold Requirement and Wind-Down Planning sections of the group ICARA which will cover their own funds and liquidity and ensure compliance with MIFIDPRU 7.9.5R (3).

The Firm is required to publish disclosures in accordance with the provisions outlined in MIFIDPRU 8 of the FCA Handbook. These requirements are supplemented by the guidance also set out in MIFIDPRU 8 published by the FCA. This disclosure is prepared annually on a solo entity (i.e. individual) basis in accordance with MIFIDPRU 8.1.7 R, since the firms in the Group are not exempt under MIFIDPRU 2.3.1 R. We believe the information provided is proportionate to the Firm’s size and organisation, and to the nature, scope and complexity of the Firm’s activities.

The annual audited accounts of the firm set out further information which complements the information in this disclosure. The audited accounts are freely available from UK Companies House.

GOVERNANCE (MIFIDPRU 8.3)

The Firm is a subsidiary of Hawksmoor Group Limited. Hawksmoor Group Limited has a clear organisational structure with well-defined lines of responsibility; effective processes to identify, manage, monitor and report the risks the Group is or might be exposed to; and appropriate internal control mechanisms, including sound administration and accounting procedures.

Hawksmoor Group Limited Structure

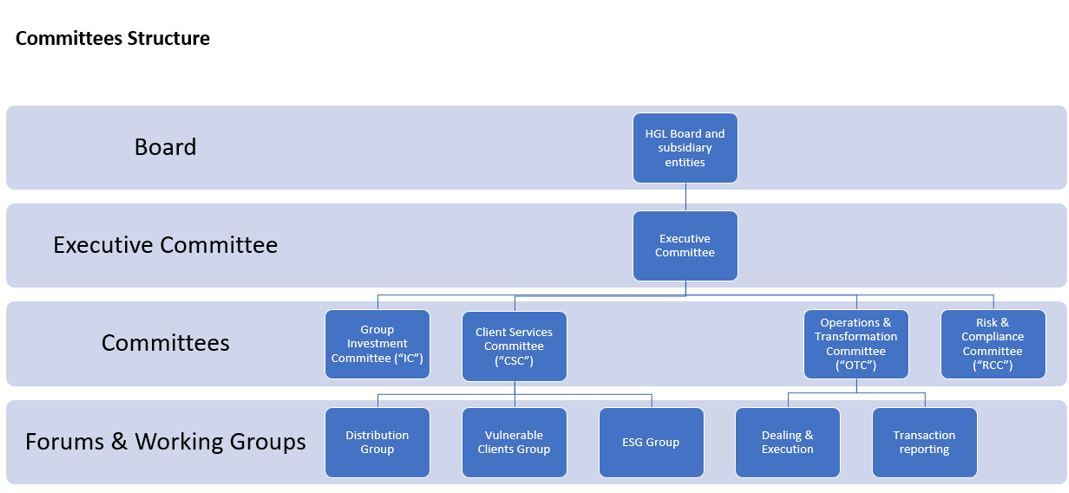

Governance is the ultimate responsibility of the Board of Directors of each MIFIDPRU entity. The Board is responsible for the ongoing success and development of the business as well as setting the risk appetite as part of the risk framework. The Board is also responsible for the firm’s strategy, long-term objectives and financial performance and ensuring the maintenance of a sound system of internal controls and risk management.

The Board is supported by other senior members of staff, who collectively form the Hawksmoor Group Limited’s Executive Committee (ExCo). The ExCo involves the Board of the Group entities (which includes the Chief Executive Officer and Chief Financial Officer), the head of each investment management division (Head of Investment Management, Head of Fund Management and Head of Investment Solutions), the Chief Operating Officer, the Head of Compliance and Risk, and the Head of HR.

Committee Structure

The ExCo and the various committees that in turn report to the ExCo support the regulated entity’s Board.

With this in mind, Hawksmoor Group maintains a Risk and Compliance Committee (RCC) at Hawksmoor Investment Management Limited which has delegated authority from the ExCo. The RCC conducts review and challenge to the Group’s risk framework and reviews the group ICARA.

MIFIDPRU 7.9.5R (5) to (7) also permits the approval of the group ICARA to one of the subsidiary MIFIDPRU investments firms within an investment firm group, when the management of any risks on a group basis takes place within one of the entities. Considering the Hawksmoor Group maintains the Risk and Compliance Committee at Hawksmoor Investment Management Limited, it is deemed appropriate that Hawksmoor Investment Management Limited approves the group ICARA.

The RCC is a key element of the governance structure and is responsible for ensuring that business management maintain a proportionate system of risk management and internal control, overseeing the management of risk events and deficiencies. Due to the size of the Group, Hawksmoor Group is not required to have its own independent risk management function. Enterprise risk management is covered by the wider Risk and Compliance Team at the RCC. The risk governance also looks at the wider scope of client outcomes and foreseeable harms. In addition to the RCC, there are further committees and working groups that report to the Executive Committee and have responsibility for the oversight of specific risk areas.

As an additional level of governance and risk management, Hawksmoor Group is subject to the Audit, Risk and Compliance Committee (“the ARC”) of Hurst Point Group Limited. The ARC reviews the overall current and future risk appetite and strategy and assists the governing body in overseeing the implementation of that strategy by senior management. Notwithstanding the role of the ARC, the Hawksmoor Group entities’ governing bodies have overall responsibility for the risk strategies and policies.

The Client Services Committee (“CSC”) sits to manage the risk associated with delivering good client outcomes and is being developed to review appropriate construction of new services, ensuring compliance with the Group product governance framework.

Operational activity is overseen through the Operations and Transformation Committee (“OTC”). The OTC reviews and monitors the day-to-day operational activities and the implementation of changes to the business functions. The OTC reviews and analyses key functions and any incidents that may arise to track their risk and remedial actions.

Hawksmoor Group’s process and style of investment management are well established, documented and supported by daily informal discussion and by the documented Investment and Fund Management meetings. The performance of the different propositions across the Hawksmoor Group are reviewed at the Investment Committee (“IC”). The committee plays a crucial role in the governance and oversight of the delivery of the different investment strategies. Comprising the Head of Divisions, some of the fund managers and Compliance. The committee. reviews the performance of the strategies and assesses market conditions.

Directorships

The below table provides the number of directorships (both executive and non- executive) held by each member of the Board as at 31 December 2023.

| Board Member | Directorships Held |

| Sarah Soar | 6 |

| Leighton Dunkley | 6 |

Diversity

We have implemented a number of initiatives and programs to foster a diverse and inclusive workplace environment for all employees. Our ‘Inclusive Workspace Group’ meets regularly to advance employee wellbeing, belonging, growth opportunities, and support for those with disabilities. This group serves as a forum to discuss challenges, share ideas, promote awareness and take actionable steps.

Additionally, we provided access to tools and resource around mental health, leadership, and DEI for all staff. We also have trained Mental Health Champions that can support those struggling with mental and emotional issues.

These efforts aim to cultivate an inclusive culture where individuals of all backgrounds feel welcomed, valued, and empowered to advance.

RISK MANAGEMENT OBJECTIVES AND POLICIES (MIFIDPRU 8.2)

Hawksmoor Group is not of a size that requires it to have its own independent risk management function. Enterprise risk management is covered by the wider Risk and Compliance Team at the RCC. The governing body is responsible for the management of risk within the Group and their individual responsibilities of the members are clearly defined. Senior management report to the Group’s governing body on a frequent basis regarding the Group’s risks. Hawksmoor Group has clearly documented policies and procedures, which are designed to minimise risks to the Group and, where deemed appropriate, all staff are required to confirm that they have read and understood them. The risk governance also looks at the wider scope of client outcomes and foreseeable harms.

Statement of risk appetite

Hawksmoor Group seeks to proactively manage risk and embrace appropriate opportunities that ensure long-term profitable growth and client harm is minimised. There is no risk appetite for any activity, event or conduct that is detrimental to, or leads to poor outcomes for, or to customers, shareholders, communities and their experiences. The Risk Appetite Statement sets the Risk Appetite of the business i.e. the risk tolerance and risk capacity Hawksmoor Group is prepared to accept in the achievement of its strategic objectives.

The Risk Appetite is aligned with Hawksmoor Strategy, business objectives and stakeholder expectations. It acknowledges the willingness and capacity to take on risk and is reflective of all aspects of the business. It also considers the skills, resources and technology required to manage and monitor risk exposures in the context of Risk Appetite. The Risk Appetite is inclusive of a tolerance or loss from negative events that can be reasonably quantified.

The Group’s governing body has adopted a conservative risk appetite to maintain a strong capital position and balance sheet throughout all market cycles with strong liquidity and a robust capital structure to protect the continuity and quality of the level of service that we provide our clients.

As an investment management group, risk is a fundamental characteristic of the Group’s business and is inherent in every transaction undertaken. As such, the Group’s approach to risk taking and how it considers risk relative to reward directly impacts its success. Therefore, the Group has established limits on the level and nature of the risk that it is willing and able to assume in achieving its strategic objectives and business plans.

A key risk the Group faces and must counter is avoiding causing harm to its clients. Additionally, strategic risk may arise from the failure to remain relevant and competitive, and some credit and market risk may arise from exposure to capital investments. The Hawksmoor Group governing body recognises that reputational risk could arise from shortcomings in any of these areas or from the wider Hurst Point Group.

Hawksmoor Group is committed to ensuring all business activities are conducted with a clear understanding of the risks, to maintaining a robust risk management framework, ensuring transparent disclosure, and treating its clients fairly, to avoid any foreseeable harm to clients, to meet the expectations of major stakeholders, including clients, shareholders, employees and regulators.

As part of the risk management process Hawksmoor Group will:

- Ensure that risk management is incorporated within processes and procedures and identify the main risks facing the Group and ways to mitigate them.

- Assess the risks to the business model and strategy, and look at the risks the Group is willing to take – the risk appetite.

- Ensure risk culture is embedded throughout the Group and that adequate risk management is discussed by the governing body.

- Ensure that the Group’s risk profile is kept under review and that measures to manage or mitigate the principle risks are taken.

- Monitor and review on an on-going basis.

- Ensure risk information is communicated to and from the governing body and internally and externally as required.

- Identity conduct risk and cultural issues to ensure good client outcomes.

OWN FUNDS (MIFIDPRU 8.4)

Table 1 shows a break-down of the Hawksmoor Investment Management Limited’s regulatory Own Funds at 31 December 2023 and confirms there are no regulatory deductions.

The Firm’s Own Funds are made up entirely of Tier 1 capital resources.

| Table 1. Composition of regulatory own funds | |||

| Item | Amount (GBP thousands) | Source based on reference of the balance sheet in audited financial statements | |

| 1 | OWN FUNDS | 5,173 | |

| 2 | TIER 1 CAPITAL | 5,173 | |

| 3 | COMMON EQUITY TIER 1 CAPITAL | ||

| 4 | Fully paid-up capital instruments | 2,255 | 18 |

| 5 | Share premium | 7,306 | 19 |

| 6 | Retained earnings | 6,831 | |

| 7 | Accumulated other comprehensive income | ||

| 8 | Other reserves | ||

| 9 | Adjustments to CET1 due to prudential filters | ||

| 10 | Other funds | ||

| 11 | (-)TOTAL DEDUCTIONS FROM COMMON EQUITY TIER 1 | 11,220 | 11 (Intangible assets) |

| 19 | CET1: Other capital elements, deductions and adjustments | ||

| 20 | ADDITIONAL TIER 1 CAPITAL | ||

| 21 | Fully paid up, directly issued capital instruments | ||

| 22 | Share premium | ||

| 23 | (-) TOTAL DEDUCTIONS FROM ADDITIONAL TIER 1 | ||

| 24 | Additional Tier 1: Other capital elements, deductions and adjustments | ||

| 25 | TIER 2 CAPITAL | ||

| 26 | Fully paid up, directly issued capital instruments | ||

| 27 | Share premium | ||

| 28 | (-) TOTAL DEDUCTIONS FROM TIER 2 | ||

| 29 | Tier 2: Other capital elements, deductions and adjustments | ||

Table 2 shows a reconciliation of Hawksmoor Investment Management’s regulatory Own Funds with its balance sheet from the audited accounts at 31 December 2023.

| Table 2. Own funds: reconciliation of regulatory own funds to balance sheet in the audited financial statements | |||

| A | C | ||

| Balance sheet as in published/audited financial statements | Cross-reference to Table 1 | ||

| As at period end | |||

| Assets – Breakdown by asset classes according to the balance sheet in the audited financial statements | |||

| 1 | Intangible assets | 11,220 | 11 |

| 2 | Property plant and equipment | 367 | |

| 3 | Trade and other receivables | 11,678 | |

| 4 | Cash and other equivalents | 2,080 | |

| Total Assets | 25,345 | ||

| Liabilities – Breakdown by liability classes according to the balance sheet in the audited financial statements | |||

| 1 | Trade and other payables | 7,997 | |

| 2 | Taxation and social security | 564 | |

| 3 | Lease liabilities | 83 | |

| 4 | Lease liabilities (non-current) | 209 | |

| 5 | Trade and other payables (non-current) | 73 | |

| 6 | Deferred tax | 27 | |

| Total Liabilities | 8,953 | ||

| Shareholders’ Equity | |||

| 1 | Called up share capital | 2,255 | 4 |

| 2 | Share premium account | 7,306 | 5 |

| 3 | Retained earnings | 6,831 | 6 |

| Total Shareholders’ Equity | 16,392 | ||

OWN FUNDS REQUIREMENT (MIFIDPRU 8.5)

The Firm’s Own Funds Requirements are determined as the highest of the following three requirements under MIFIDPRU 4.3.2 R:

- Permanent Minimum Capital Requirement (PMR) – £75k (MIFIDPRU 4.4R)

- Fixed Overheads Requirement (FOR) – £2.578m, one quarter of the Firm’s annual fixed overheads (MIFIDPRU 4.5.1.R), unless there is a material change expected to projected expenses during the year (MIFIDPRU 5.7R)

- K-factor requirements – (k-AUM) + (k-COH) + ongoing activities – £1.785m a breakdown of which is provided below.

The Firm’s Own Funds Requirements are therefore determined by the FOR, i.e. £2,578m which is the highest of these three.

The ‘K-factor’ approach was introduced by the IFPR to determine the minimum own funds requirements of an investment firm that is not an SNI. The aim of the K-factors is to provide a tailored and more appropriate method for setting a risk- based minimum own funds requirement for all types of investment firms.

The K-factors relevant to the Firm include the following:

- K-factor requirement calculated on the basis of Assets under Management (k-AUM).

- K-factor requirement calculated on the basis of the Daily Trading Flow (k-DTF). DTF is measured as a rolling average over the previous 9 months but excluding the 3 most recent months.

| K-factor requirement: (Sum of) | Amount (£000’s) |

| k-AuM | 686 |

| k-CoH | 2 |

| Additional capital from Ongoing Operations | 1,097 |

| Total K factor assessment | 1,785 |

The Firm utilises a number of approaches to ensure that it remains compliant with the overall financial adequacy rule under MIFIDPRU7.4.7R, both in terms of own funds and liquidity resources.

Foremost is the annual assessment of own funds and liquidity adequacy conducted during the ICARA process, which considers the Firm’s resource requirements under ‘business as usual’ and a variety of severe yet plausible stress tests.

In the case of our Own Funds, these requirements are forecast over a three-year time horizon and test the key sensitivities of the Firm’s business. The Firm then ensures that its current level of financial resources is adequate to remain a going concern during this period under all scenarios considered.

Included within the ICARA is also an assessment of the capital required to affect an orderly wind down of the business. This figure is compared to the Firm’s Own Funds requirement as detailed above. As at the time of writing the Firm’s OFR is greater than its wind-down capital requirement.

REMUNERATION POLICY AND PRACTICES (MIFIDPRU 8.6)

The long-term success of Hawksmoor Group depends on its ability to attract and retain top talent. The Group’s remuneration policy is tailored to assist in achieving that outcome.

The FCA’s Investment Firms Prudential Regime (“IFPR”) took effect on 1 January 2022. The IFPR contains a remuneration code with which the Hawksmoor Group’s principal investment management firm, the Group firms, must comply. This includes having a remuneration policy, which must:

- be proportionate to the nature, scale and complexity of the risks inherent in the Group’s business model and activities.

- be gender neutral.

- be consistent with, and promote, sound and effective risk management.

- be in line with the Group’s business strategy and objectives, and take into account long term effects of investment decisions taken; and

- contain measures to avoid conflicts of interest, encourage responsible business conduct and promote risk awareness and prudent risk taking.

The Group is a non-SNI MIFIDPRU Investment Firm Group for the purposes of the FCA rules in the MIFIDPRU Remuneration Code has implemented in SYSC 19G of the FCA Handbook. It is required to implement the FCA’s “standard” approach to remuneration for non-SNI Firms.

This policy applies to employees of the Firm. The Firm is a wholly owned subsidiary of Hawksmoor Group Limited (“HGL”), which wishes to adopt a common approach to remuneration for the group of companies of which it is the holding company (comprising HGL, the Firm, and certain other regulated and non-regulated subsidiaries of HGL from time to time (each a “Group Company”).

Material Risk Taker

FCA rules state that a “Material Risk Taker” (or “MRT”) is a staff member whose professional activities have a material impact on the risk profile of the Group or the assets that it manages. The Group reviews on an annual basis which staff are Material Risk Takers for these purposes

Gender neutral pay policy

The Group is committed to ensuring that remuneration is based on the principle of equal pay for workers of any sex for equal work, or for work of equal value.

Fixed remuneration

The Group’s policy is to ensure that all staff have appropriate basic salaries which represent a sufficiently high proportion of their total remuneration to enable the operation of a fully flexible policy on variable remuneration, including the possibility of paying no variable remuneration.

Variable remuneration

The Group operates a discretionary bonus scheme. The amount of bonus awarded is based on the application of a balanced score which takes into account financial and non-financial criteria.

Performance adjustment

The Group is committed to ensuring that employees approach their roles in a way that reflects the Group’s risk appetite, strategy, culture and values. The Group’s approach allows it to take appropriate, and proportionate, action if matters come to light which evidence a failure by a Material Risk Taker to meet the standards expected of them. This includes making adjustments to components of variable remuneration to reflect any such failure to meet those standards as follows:

- reducing current year awards (This is known as “In-Year Adjustment”);

- the Group may reduce the amount of the unvested award in the circumstances set out in the table below. This is known as “Malus”. Malus will normally only be applied where an award has been deferred; and

- the Group may seek recovery of some or all of the variable remuneration in the circumstances set out in the table below. This is known as “Clawback”.

The period within which Clawback may be applied is three years from the date of vesting.

Quantitative Remuneration Disclosure:

The total amount of remuneration awarded to senior management and material risk takers, and all other staff, split by fixed and variable remuneration in GBP is as follows:

| £m’s | Senior Management and other Material Risk Takers | All other staff | Total |

| Fixed remuneration | 1.3 | 4.3 | 5.6 |

| Variable remuneration | 0.3 | 1.5 | 1.8 |

| Severance payments | 0 | 0.1 | 0.1 |

| Total | 1.6 | 5.9 | 7.5 |

The total number of material risk takers identified by the Firm under SYSC 19G.5 was 9.

The disclosure in the table above has taken advantage of the exemption in MIFIDPRU 8.6.8R (7) (b) and MIFIDPRU 8.6.89R to prevent the individual identification of a material risk taker’s remuneration by breaking down further the disclosure for the MRT holders in the table.