January 2018

Under new PRIIPs legislation, from 1 January 2018, all listed investment companies (also referred to as ICs, investment trusts, Real Estate Investment Trusts (REITs) or closed-ended funds in this note) have to produce a Key Information Document (KID) in order for their shares to be made available to retail investors.

There are merits in having a standardised document that presents independent information on an investment company, rather than investors relying on management groups’ own promotional factsheets. Unfortunately though, these documents appear flawed and are, in our view, actually misleading when it comes to details of expected risk/returns and the underlying costs.

Open-Ended Investment Companies (also referred to as OEICs or unit trusts in this note) already provide Key Investor Information Documents (KIIDs) under UCITS legislation but are not required to disclose the same level of detail until January 2020.

Performance Scenarios

In these new KIDs, investment companies are not allowed to show past performance. Instead, following strict instructions from the Financial Conduct Authority (FCA), they have to produce illustrations of the likely returns investors may receive under four different performance scenarios ranging from ‘stress’ to ‘favourable’, without explaining what the definitions of those conditions mean.

One of the basic regulatory messages providers of investment products must disclose on all literature is that ‘past performance is not a guide to future performance’ yet these new forecasts are based purely on the past 5 years – one of the most favourable periods for investors in the history of financial markets and a period when the discounts on most investment companies have narrowed. Therefore there are certain ICs whose performance under the most negative ‘stress’ scenario are actually not that bad and others where even under the most ‘favourable’ scenario are still not very good.

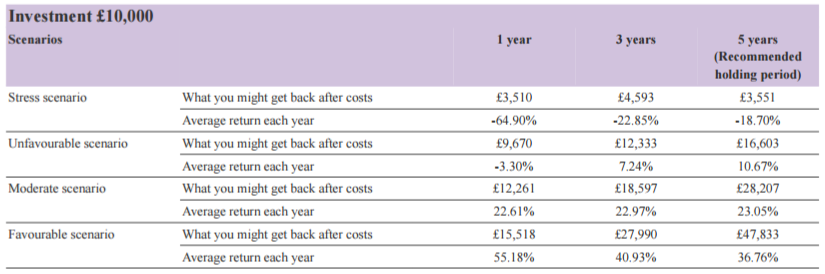

For example, the KID for Scottish Mortgage, the largest UK investment company with £7bn in assets, shows a potential loss of only 18.7% per annum, over five years, under the (worst case) ‘stress’ scenario, yet

- it has 8% structural gearing

- its share price trades at a premium to its net asset value (NAV)

- in 2008 (a period most investors would describe as stressful!), its share price fell 60% within 6 months (from 140p in May to 56p in November 2008).

Quite rightly, the manager James Anderson and a board member, John Kay, have publicly criticised these projections as misleading and that they lull investors into a false sense of security.

Scottish Mortgage Investment Trust PLC Key Information Document

…it highlights the potential for confusion amongst retail investors – the very people this new document is designed to assist.

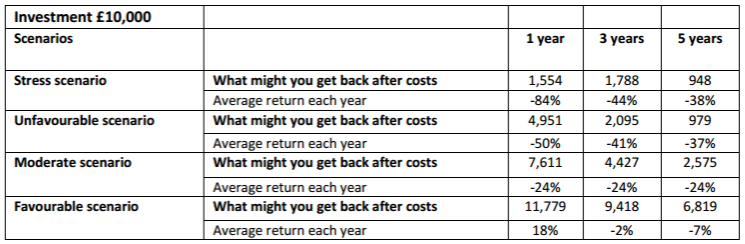

Meanwhile, an example at the other end of the spectrum is a small investment trust, Golden Prospect, whose KID shows projected returns in the most favourable conditions as being a loss of 7% p.a. The environment for junior gold mining companies over the past 5 years has been difficult which has caused this trust’s assets to fall and its discount to widen, but often this is exactly the right time to buy shares in an investment trust. A recovery in the assets and a turnaround in the sentiment towards the shares narrows the discount and generates superior returns.

Golden Prospect Investment Trust Key Information Document

One last example of a flawed forecast involves Capital Gearing, an investment company whose principal mandate is the preservation of capital, but its KID shows a loss of 100% in the event of a ‘stress’ scenario. While this is clearly an error or a misinterpretation of the calculations, it highlights the potential for confusion amongst retail investors – the very people this new document is designed to assist.

Investing in financial assets is incredibly difficult as it relies on making judgements about the future which is obviously unpredictable and involves taking risks. In our view, a document that relies on the future being similar to the recent past and that seeks to ascribe a precise outcome on a vague set of conditions is very misleading.

Transparency of Fees

From our perspective as a fund-of-funds manager, perhaps the most contentious element of these new KIDs has been the requirement to disclose all costs involved in managing the investment company and report a ‘genuine’ Ongoing Charge Figure (OCF).

As active managers, we absolutely agree with the need to be transparent with investors as we need to demonstrate the added value we can provide above that offered by a passive solution. However, there appear to be inconsistencies and unfair costs in these calculations.

For example, we have a significant allocation in our Funds to direct or physical property via Real Estate Investment Trusts (REITs) and these now have to disclose their transaction costs including stamp duty, which in our view are simply costs of doing business for a property fund. Property companies structured as a public limited company (PLC) such as British Land or Land Securities do not need to disclose an OCF, while open-ended property funds like M&G Property Portfolio, do not need to disclose the same level of costs for another 2 years.

Every listed company incurs costs in order to carry out its primary business function, whether that is BP drilling oil or GlaxoSmithKline investing in research and development to discover new drugs, yet only those structured as REITs and investment companies currently need to disclose these new OCFs. Importantly, an OCF of an investment company or REIT does not directly affect the return investors may receive as that is dictated by the performance of its share price – which is driven by the difference between demand and supply – which can result in shares trading at a premium or a discount to NAV. As the costs are incurred at the NAV level, how does one calculate the true OCF of a trust that is trading at a discount?

Does it change our view?

It is worth explaining too that just because the disclosed OCF of investment companies and REITs will rise, they don’t suddenly cost more. Past performance reflects these costs that have always been in place – REITs have always had to buy and sell property. So just because they have to report the costs involved now, doesn’t detract from the past, or prevent us from investing in them in the future.

…if we had been obsessed by OCFs we would have missed the opportunity to significantly improve the returns for our investors.

We have shown through active management and accessing different asset classes that can only be found in investment trust sectors like private equity, REITs and specialist bond funds, that they enhance the prospects of returns greater than if only investing in open-ended funds. Take Phoenix Spree Deutschland for example. We invested in this Berlin residential property company in 2015 and it has delivered a total return in excess of 100% since we have owned it. As it has not had to report its OCF we have not had to include it within our own calculations. According to its KID it has an OCF of more than 8% p.a. which on the face of it is very off-putting but as explained above, it has to incur costs to deal in property and if we had been obsessed by OCFs we would have missed the opportunity to significantly improve the returns for our investors. Internal analysis demonstrates that investment trusts have added considerable value over the years; in 2017, investment trusts represented on average 29% of Vanbrugh’s portfolio yet contributed more than 50% of the return. For further information on the importance of investment trusts, read this article.

Industry Concern

Judging by the comments in the press and feedback from the managers and directors of investment companies, there is a high probability that the KIDs will be revised. But in the meantime, we worry that the nonsensical return outcomes and the inconsistent and misleading high OCFs could act as a deterrent to certain investors. Retail investors reading the KIDs before buying a trust on any well-known platform may be put off from buying something that has an unfavourable symmetry of returns based on the past performance, while institutional investors, such as a fund-of-funds or pension fund, may not want to buy an investment trust that is deemed superior to its open-ended equivalent for fear that their own consequently higher look-through OCF will deter investors.

Despite the illusion of higher costs on our own Funds, compared to passive solutions or funds that only invest in open-ended funds, we will continue to strive to demonstrate the added value investment trusts offer in terms of investment opportunities and diversification benefits, and continue to produce superior risk adjusted returns for our investors. We hope that the regulators’ obsession with costs will not hinder the true objective of any investors; to maximise real returns after charges and taxes.

It is surprising that there was not more consultation with the industry ahead of the publication of KIDs which may have avoided these problems. The situation is quite fluid due to the industry outcry and is therefore subject to change, which we would encourage and endorse.

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation. They are subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. The situation is quite fluid and is subject to change. All figures sourced from Numis Securities. HA2264.