28th October 2022

Back in January 2021 we wrote an article called ‘Time for a Different Approach’ in which we argued that the traditional 60/40 equity/bond portfolio might well struggle to deliver on client objectives going forward owing, in large part, to expensive equity and bond valuations. We also suggested that a more innovative approach to multi-asset investing would be required and particularly one that could look beyond equities and bonds and embrace the use of alternatives. Accordingly, our funds have had significant exposure to real assets which we felt were capable of delivering positive real returns for our investors at a time when large parts of bond and equity markets were failing in this regard.

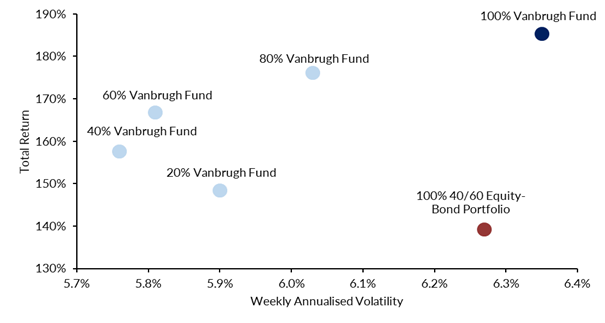

Despite our conviction in this view, humility is something of an underappreciated attribute in asset management, and we recognise that there is no definitively right or wrong way to invest. No one has yet solved investment and we acknowledge that passive funds have done an excellent job of accessing more liquid markets at low cost for investors. In this spirit we have spoken to clients and potential clients about the benefits of blending truly different multi-asset funds and how this could result in more robust portfolios. The empirical evidence which supports this contention is highlighted in the chart below which demonstrates how introducing a truly active multi-asset fund like Vanbrugh alongside a more traditional equity-bond portfolio can improve risk-return profiles.

Source: FE fundinfo, 18/02/2009 to 30/09/2022. 40% equities represented by MSCI World All Cap, 60% bonds represented by ICE BofA Global Broad Market Hedge GBP.

Wind forward to today and the world has changed somewhat. Following this year’s sell-off, prospective returns from fixed income have vastly improved, whilst the same can be said of certain equity markets as well. As discussed in previous blogs, we have been reacting to shifting valuations and have made significant changes to the Funds, reducing exposure to real assets and increasing exposure to credit and, to a lesser degree, equities.

Do these developments appease our concerns with the traditional 60/40 approach or invalidate our believe in the benefits of blending? Not really. Derived from our benchmark agnostic, unconstrained approach, our funds remain highly differentiated, and we think this is important in a world where large parts of capital markets remain expensive.

Within fixed income we have very limited exposure to conventional government bonds where we’re reluctant to make big macro driven calls on rates and where real yields remain negative. Nominal government bonds are very well represented in both global bond indices and many passive multi-asset funds and are a major driver of the significant interest rate sensitivity inherent in both. In contrast, the duration of our Fund’s bond exposure is much lower, around 3.8 years for Vanbrugh and 3.3 years for Distribution. Within credit we are adopting a very targeted approach considering specific areas such as floating rate structured credit, asset backed direct lending and hybrid bonds as well as more vanilla areas. The pitfalls of investing in inherently less liquid corporate bond markets via passive ETFs is probably worthy of a blog in its own right. Suffice to say, in all cases we are accessing the market via experienced, highly active managers at the helm of relatively small, nimble funds who are able to move quickly and who have access to a broader investment universe including smaller issuers. Significantly higher return expectations than those available at the index level (with reference to yield to maturity and yield to worst), are the output of this active approach.

Large parts of the US equity market continue to look expensive despite the sell-off so far this year. With the US accounting for almost 70% of MSCI World, passive and benchmark aware multi-asset approaches will have significant exposure to this market. As a result of our valuation discipline, we do not (Vanbrugh c.3%, Distribution c.2%, Global Opportunities c.9%). We are seeing pockets of value elsewhere and are happy to take conviction positions in areas that don’t constitute a big part of the index. UK and Japanese smaller companies as well as Asian Income certainly fall into this bracket. Valuation dispersion across many equity markets is also high, providing a fertile hunting ground for active managers to generate alpha which informs our overriding preference for high conviction, benchmark agnostic approaches as opposed to passive, index tracking ones.

We also continue to retain meaningful exposure to real assets and other alternatives including private equity, creating a further point of difference with passive multi-asset solutions.

Finally, it’s worth pointing out that the above chart relates to 13 years of Vanbrugh’s history, a period in which our exposure to alternatives will have fluctuated considerably. The point here is that the benefits of blending our Funds with passive and benchmark aware multi-asset solutions are not so much about asset allocation at any given point in time, but instead are derived from our unconstrained, valuation led process and the broad investment universe we enjoy access to. Those attributes of our philosophy are mainstays, and like the benefits of blending have merit and longevity through the cycle.

Ben Mackie – Fund Manager

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC649.

Source: MSCI. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its Third Party Suppliers and has been licensed for use by Hawksmoor Investment Management Limited. ICE Data and its Third Party Suppliers accept no liability in connection with its use. See https://www.hawksmoorim.co.uk/ice-data-indices-disclaimer/ for a full copy of the Disclaimer.