March 2020

These are clearly extraordinary and highly uncertain times from a humanitarian, social and economic perspective. During the quarter, financial markets declined at the fastest pace on record. Our Funds were not immune from these falls. We have long communicated to our investors our concerns that valuations in mainstream equity and credit markets looked extended and that in constructing our portfolios, we seek to avoid the most expensive areas of financial markets and instead ensure that each investment offers a margin of safety, uncorrelated returns, or a combination of both. Over recent years, this more cautious approach has seen our exposure to traditional equities and bond markets fall. The corollary of this is a higher allocation to more idiosyncratic risk and investments that exhibit limited correlation to mainstream financial markets. These include lowly-geared investment trusts investing in private equity, direct loans, ships, song royalties and targeted areas of the property market. Whilst we hoped that this cautious approach would stand us in good stead during a more difficult period for financial markets, we always accepted there was a risk that in the short term the prices of some of these investments could detach from fundamentals. This has been the case, and our Funds have therefore not been immune from the broad based nature of the selloff. In absolute terms, our three Funds have protected capital better than equity markets. Taking the MSCI United Kingdom Index as a proxy (given the majority of our investors are based in the UK and have sterling liabilities), downside capture during the sharp falls between 19th February 2020 and 23rd March 2020 was 52% for Vanbrugh, 71% for Distribution and 85% for Global Opportunities. Nevertheless, we are disappointed with the absolute returns the Funds have generated during the declines.

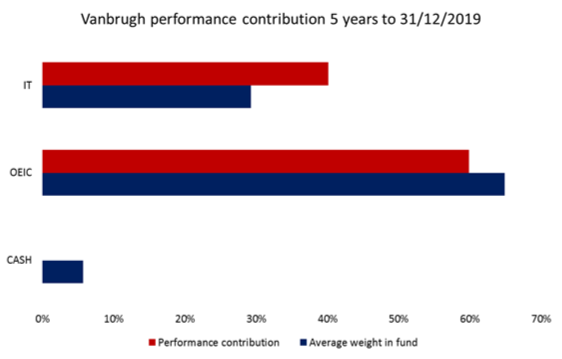

You will recall that we use investment trusts to gain access to asset classes that either cannot (i.e. private equity) or should not (i.e. property) be accessed through open ended vehicles. Over the years, investment trusts have been a big positive contributor to our Funds’ returns, with their contribution to performance far in excess of their overall weight in the Funds. The below chart shows the average investment trust exposure and the proportion of returns generated by investment trusts in Vanbrugh over the five year period to the end of December 2019. In recent weeks, however, price falls have been indiscriminate across financial markets, but in particular within the investment trust universe. Going into the recent market falls, Vanbrugh had 31% in investment trusts, Distribution 42% and Global Opportunities 47%, with investment trusts contributing 51%, 52% and 52% respectively of the performance of the Funds during this difficult period.

Source: Internal and FE Analytics.

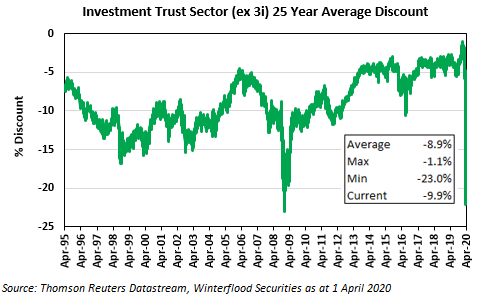

There are a number of factors that we believe have contributed to the rapid widening of investment trust discounts in the short term, but three in particular stand out. The first, and arguably most important reason for the speed of the declines, is liquidity. Never before has the majority of the investment community and in particular the market-making community been working from home at the same time, and it was natural to expect a short transition period as communication lines were being fully established. Traders lacked the confidence to step in and deal in size in the market. The second factor is sentiment. During the financial crisis over a decade ago, discounts widened rapidly, most notably for property and private equity trusts. The scars of those moves live fresh in the memories of many investors, and a number of market participants began panic selling positions into falling markets. The effect of these two technical factors simultaneously occurring was both unprecedented and unforeseeable, but they were augmented by a third factor – uncertainty over what impact the coronavirus and resulting economic slowdown might have on to the underlying net asset value (NAV) of trusts. This triumvirate combined to spook a number of investment trust participants into making the decision to sell first, and ask questions later. This led to price falls that in many cases were completely irrational, with price falls far in excess of any reasonable (and most unreasonable!) scenario for the long term impact of coronavirus. The below chart emphasises both the speed and the extraordinary scale of the widening of discounts across the investment trust universe.

Source: Winterflood Securities to 01/04/2020.

We did not panic. The first two levels of uncertainty mentioned above are a function of market technicals, which whilst exerting a short term influence on market moves tend to have limited impact on longer term fundamentals. Changes in market liquidity and other technical factors are also hard to predict and as such our process does not expend too much time trying to forecast here, but we do embrace the fact that technicals can create shorter term investment opportunities around better entry and exit points for nimble investors such as ourselves. The third factor, looking at the fundamental drivers of an investment trusts performance and making a probabilistic assessment of the expected impact on the NAV and the income we expect a trust to generate and pay out, is always where the bulk of our analytical work is focussed and this is as true of late as ever. During the past two weeks, the HFM team have conducted in excess of 70 (virtual) meetings with managers from across all of the asset classes in which we invest. This has augmented our views and helped us build a comprehensive picture of the current investment environment allowing us to assess where opportunities may lie, and also where price falls may not yet reflect the deterioration in fundamentals. The benefit of being able to access best in class managers, experts in their respective fields, at such short notice has been an incredibly valuable resource to tap into at a time when events are developing rapidly. In recent weeks, these meetings have given us the confidence to use some of our elevated cash levels to achieve fantastic long term entry points into some investments in both the open ended and closed ended arena. Significantly our research has led us to believe that much of the unwelcome volatility the Funds have had to endure over the past month due to the sharp moves in our investment trust holdings has not resulted in a permanent loss of capital. We look at two asset classes where we have identified opportunities below.

We went into the market falls with elevated exposure to real estate investment trusts relative to history. At a time when yields available from traditional sources such as government and corporate bonds were paltry, income from certain areas of the property market appeared highly attractive. We are very selective in our property exposure, utilising best in class managers who are experts in their fields to take advantage of long term structural themes in very specific sub- sectors such as use of care homes and the shift towards online shopping, of compelling supply/demand dynamics in regional offices and private rented sector homes, and of inflation linked government backed revenue streams. Property trusts today are very different from the financial crisis, when the sector was composed of generalists who were jack of all trades, and masters of none, deploying vast amounts of covenant heavy leverage into their buildings in order to boost returns. Today, leverage levels are considerably lower, and interest cover costs are cheap thanks to incredibly low interest rates.

All of the trusts we invest in have significant room on all of their covenants, have long term debt in place that doesn’t need to be refinanced, and work incredibly closely with all of their tenants and the banks. Despite this, property trust prices fell in line with UK small cap stocks. We spoke to all of our property trust managers, and were surprised to hear of a lack of engagement from other investors despite the opportunities that appeared to be materialising. We gained the confidence to selectively add to areas where the price fall appeared indiscriminate, where we had confidence in the strength of the trusts balance sheet, and where the long term opportunity and thus income generating potential in our assessment was not impaired, even if there would be a short term hit. Examples of our dealing include topping up Impact Healthcare REIT at 68.5p (currently over 83p), Civitas Social Housing at 78p (now over 93p) and a small top up in Regional REIT at 51p (now over 80p as I write). Despite several price rebounds, we still believe there is significant value in very select areas of property markets.

We have identified a very good opportunity developing in corporate bond markets, where the recent drawdown has resulted in widening credit spreads that are now pricing in an unprecedented increase in corporate defaults. The sell-off has been indiscriminate, driven in part by redemptions and forced selling which has created a fertile hunting ground for our trusted, active managers. Corporate bond prices may well head lower still in the coming weeks and months but we take comfort from the confidence our managers have in the solvency of their underlying portfolios and see current yields and spreads as offering a decent margin of safety. Central bank action to support fixed income markets in recent weeks is also important and has helped restore liquidity in investment grade and high yield markets alike. We expect many companies to cut dividends in the coming months to help shore up balance sheets and for cash flows to be diverted away from shareholders towards bondholders. The fact that companies are legally obliged to meet coupon and principal payments on their debt, provides us with greater confidence in the security of income offered by corporate bonds relative to that offered by equity dividends. We have therefore taken the decision to materially increase exposure to mainstream credit across our three funds through the (re-)introduction of Schroder Strategic Credit and Royal London Short Duration Global High Yield Bond and Man GLG High Yield Opportunities. We recently sold RLSDGHYB across all of our mandates but in the weeks following this sale, the fund has fallen c.12%. In recent years, the fund has broadly offered a cash-like total return profile of LIBOR +250bps to investors. This has rapidly changed. High yield spreads have widened sharply and the gross redemption yield on the fund has risen to 8.2%, despite the fact that the portfolio has 20% in cash. It is a similar story for Man GLG High Yield Opportunities which invests in high yield corporate bonds and has the ability to short credits, and Schroder Strategic Credit, which owns a mixture of investment grade and high yield bonds. For Schroder Strategic Credit the effective yield on the portfolio was 3.8% at the end of February, it is close to 8% today.

In the same way that we have been dynamically shifting exposure in our Funds, we believe that the active managers that we invest with are very well placed to take advantage of the dislocations that are occurring in their respective asset classes. The ability to act swiftly to rotate portfolios towards the most compelling opportunities in their specialist fields will provide the foundation for attractive long term returns from today, with many expressing genuine excitement about the scale of the opportunity that is beginning to present itself. The road ahead is going to be bumpy, but our Funds are in a strong position to be able to selectively and carefully take advantage of these opportunities with our elevated cash position and ability to quickly and dynamically adjust our portfolios. We are acutely aware of the responsibility you have placed in us to manage your savings, and we are immensely grateful for the faith you have shown in us to navigate through this difficult period. As investors in all three Funds, alongside our family, friends and colleagues, we share in your experience, and we are as determined and focused as ever to deliver good outcomes for our clients. We are always happy to talk to investors, so if you have any further questions, please don’t hesitate to get in touch.

Dan Cartridge – Assistant Fund Manager

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation. They are subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA3761