September 2020

In April we wrote to you in order to highlight how we thought coronavirus would impact the Distribution Fund’s income profile.

We told you we expected the prospective dividend yield to be 3.95% – not vastly different to the yield the Fund has delivered historically.

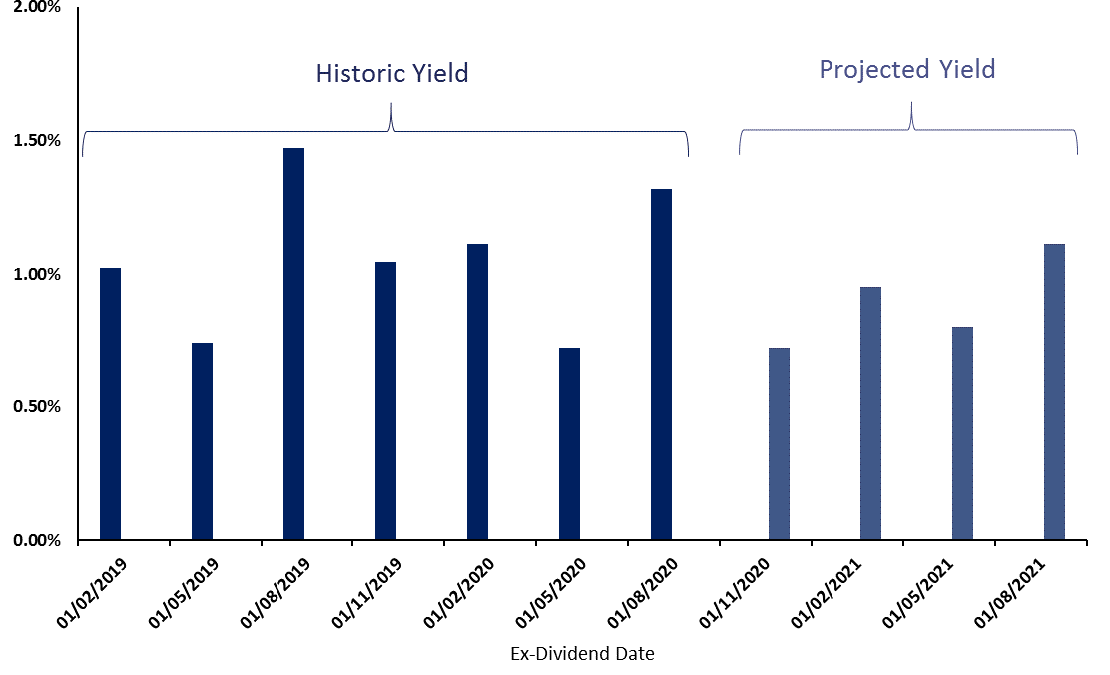

Today we can update you now that we know what the Fund has distributed in the subsequent two quarters since our April note (ex-dividend dates 01/05/2020 and 01/08/2020) and can provide an updated projected yield.

What are our new income expectations?

This updated chart still shows the historic yields for the whole of 2019 and the first payment of 2020, but now includes the actual yields for the two ex-dividend dates which have passed. The chart also includes our updated projected yields for the subsequent two quarters, and we have added another two quarters of projected yields to inform you what yield to expect from the Fund over the next year.

Source: FE Analytics and internal, C Inc units, 31/08/2020.

We are on track to deliver a yield almost exactly in-line with what we guided you towards, with the projected yield for an investor holding the Fund at the time of our first note now being 3.97%.

Further, we have updated our forecasts for the upcoming quarters and we now forecast an annual yield from today of 3.88%.

Why does our projected yield remain high?

The fact that this remains high – even after a c. 12% increase in the unit price is for the following reasons:

- We have lower levels of cash in the portfolio, having invested this cash into existing and new holdings to reflect greater confidence in their return prospects and having taken advantage of share price weakness to invest at attractive entry points.

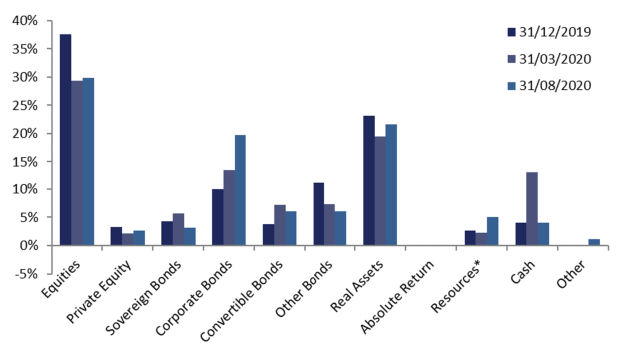

- The make-up of the portfolio has changed (see below chart), with a greater weight in credit funds (where the surety of the income delivery is higher than other asset classes) and also to equity “maximiser” funds, where delivery of the income is partly achieved by selling options (which will generate income even if the underlying equity sees its dividend cut).

Source: Internal, *including precious metals.

Moreover we believe the 3.88% annual yield forecast is conservative for the following reasons:

- For the rest of this year, while we have updated our forecasts, we still remain conservative on the income generation of some parts of the portfolio.

- For the first three months of 2021, we are still applying haircuts to dividends from large parts of the portfolio.

- For April, May, June, July and August next year, we are assuming the same income delivery as this year – this allows for no recovery in dividends – especially from some parts of the equity market.

Stability of income

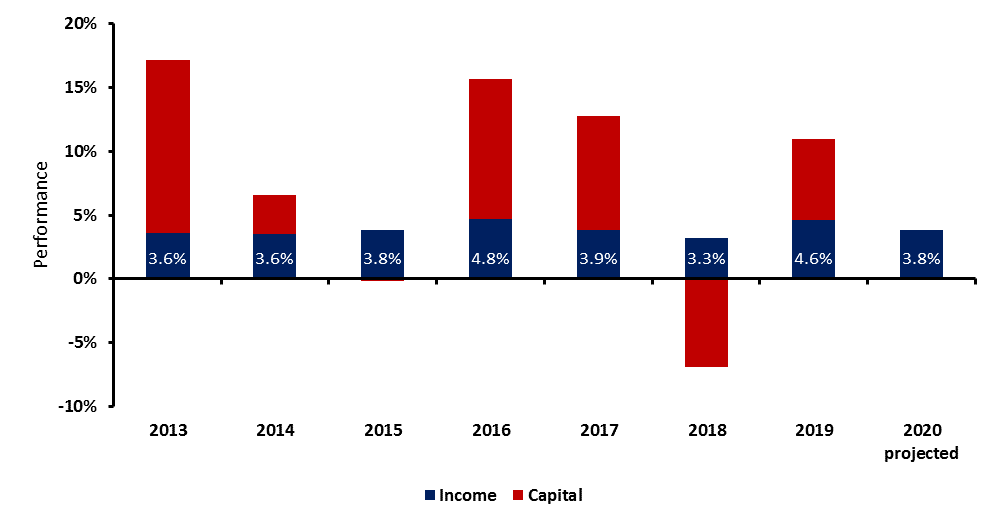

Below you will see the historic annual yield delivery (in combination with capital) – showing a robust income delivery profile. Our 2020 projected yield includes the three income payments that we already know and our projection for XD date 01/11/2020. While the capital performance has been volatile, the income performance has been remarkably stable. The robustness of the income profile leads us to believe the recent volatility in capital has not resulted in permanent losses.

Source: FE Analytics, C Inc units, 01/01/2013 to 31/08/2020.

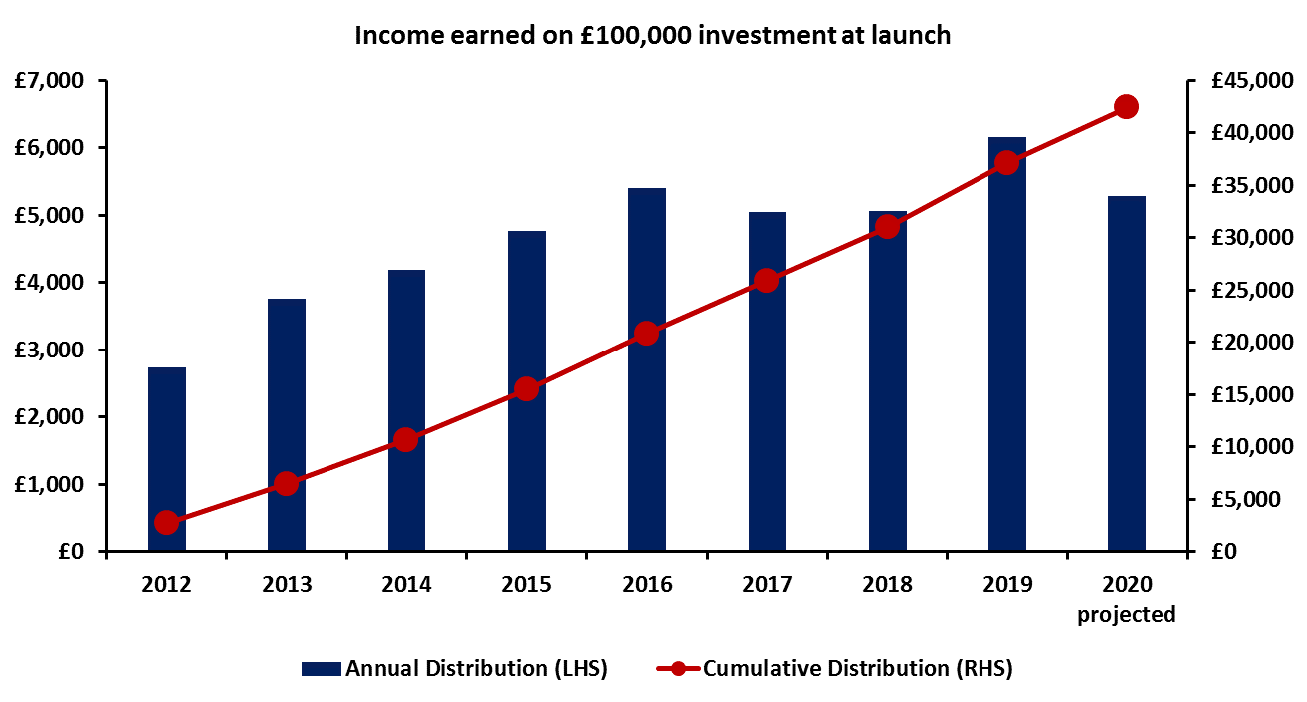

To conclude, despite what the coronavirus has thrown at us, we remain optimistic at preserving the Distribution Fund’s excellent income track record.

Source: Internal, C Inc units, 13/04/2012 to 31/08/2020.

We will soon start to publish a quarterly-updated chart pack of the Distribution Fund’s yield history, with accompanying useful supplementary information, on our website.

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA4024.