May 2020

Many of you will have read our articles or listened to our webinars over recent weeks where we have discussed how the Hawksmoor Funds performed during the COVID-19 market sell-off. The purpose of this note is not to repeat all we have covered before but to update you on what has happened since March and what the team has been doing. However, in order to explain the current strategy we do need to briefly cover the painful period in March where our Funds’ exposure to investment trusts contributed to poorer than expected performance.

The impact of investment trusts on our Funds’ performance

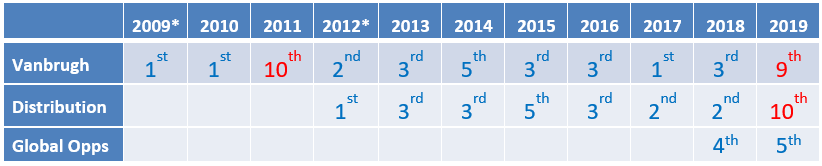

The dramatic widening of investment trust discounts witnessed in March was more extreme than during the Great Financial Crisis of 2008/09, mainly because it occurred over such a short period. The following discrete performance tables highlight the impact on the Funds’ performance of these nine trading days.

Discrete calendar year performance relative to respective IA Sector in deciles: *part years – 2009 Vanbrugh 18/02/2009 to 31/12/2009. 2012 Distribution 13/04/2012 to 31/12/2012

*part years – 2009 Vanbrugh 18/02/2009 to 31/12/2009. 2012 Distribution 13/04/2012 to 31/12/2012

2020 broken down into three discrete periods relative to respective IA sector in deciles: Source: FE Analytics.

Source: FE Analytics.

Our three Funds have a consistent record of sector-beating returns apart from just three periods:

- The period 12th – 24th March, for the aforementioned reasons;

- The Euro crisis in 2011 when investment trust discounts also temporarily widened but created great investment opportunities for future returns;

- In 2019 when good absolute returns in Vanbrugh and Distribution were not enough to keep up with expensive, momentum-driven markets (although Global Opportunities did still participate).

We have always communicated that investment trusts are a strong source of value and opportunity for our Funds and that this differentiates them from their peers with similar mandates. The exposure to alternative assets classes, that are unavailable in open-ended funds, provides us with a much broader set of opportunities and increases diversification. However, in times of crisis, because they are listed instruments, they can correlate with general stock markets even if their underlying assets are not equities.

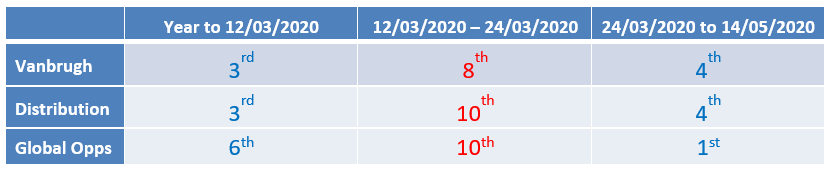

Types of property exposure

Included in our investment trust exposure is our property allocation. Real Estate Investment Trusts (REITs) correlate with property over the long term but can correlate with equities over the short term and this recent episode showed that relationship remained true. While this is a risk we are prepared to accept, believing this to be temporary volatility rather than a permanent loss of capital, what compounds the recent disappointing performance is the divergence in the valuation of open-ended property funds (red line) and the REITs (blue line) as the chart below shows.

Source: FE Analytics.

Source: FE Analytics.

We believe there could be steep losses to come in the value of open-ended property funds (many of which are suspended preventing investors from redeeming) if the current prices of the UK REITs accurately reflect the true fundamentals in the property market. Alternatively, if the property market is not as bad as the REIT prices suggest then there is much better value in the REITs today.

It is important to state that while the two sectors represented by the lines on the chart above represent broad allocations to UK commercial property which includes retail, offices and industrial, much of our property exposure is targeted in areas with little impact from the lockdown. This includes social housing or logistics warehousing which have seen their share prices bounce back to close to their pre-crisis levels. However some REITs, such as those investing in the private rented sector or care homes, haven’t fully recovered but we believe their fundamentals remain intact and represent a store of value.

Dealing activity in investment trusts – 2011 vs. 2020

The reason for discussing this period of pain our investors have felt from investment trusts is to help explain what we have done in the Funds in response, since it is the opposite to action we took in the last period of dramatic discount widening in 2011.

Back then, there was tremendous value in conventional investment trusts where discounts widened and the underlying asset values also fell, giving us confidence that increasing exposure to investment trusts would see us benefit from the ‘double whammy’ effect of a narrowing discount combined with a recovering net asset value. The subsequent performance of Vanbrugh in 2012 and 2013 was a consequence of the seeds sown in 2011.

What is different today is that while we did take advantage of some extreme movements during March and April by buying and selling certain investment trusts, the net result is that we have a lower allocation to investment trusts after the crisis than before.

We have maintained a material position in investment trusts that provide exposure to our favoured themes such as specific parts of the property market and alternative assets such as ships and songs, but have reduced or sold some of the more economically sensitive and less liquid names such as those investing in emerging markets, small caps, private equity and loans.

We did this for the following reasons:

- We were disappointed at how investment trusts disproportionately impacted the performance of the portfolios and recognised that despite the underlying assets predominantly being in defensive, non-equity investments, the extent of the discount volatility effectively negated the low equity allocations the Funds held going into the crisis.

- Given that we remain cautious on the outlook for financial assets, we cannot rule out another period of weakness or stress and therefore want to limit the potential of disproportionate losses similar to what happened in March.

- The vast majority of our investment trust exposure today is to access alternative asset classes rather than the conventional assets we held in 2011, with plain vanilla equity trust discounts offering much less value this time around.

- Further, after an extensive period of researching all asset classes during the past 3 months (>150 phone or video meetings with fund managers) we discovered better risk reward potential in other areas, and therefore to finance an increase in one area, we had to reduce exposure to another, and that included investment trusts.

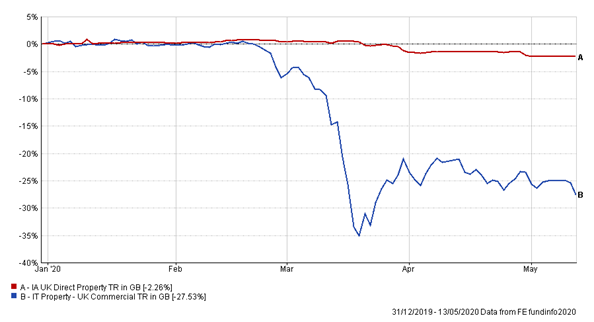

The chart below shows the main changes to the Fund’s asset allocation during 2020 so far: Source: Internal.

Source: Internal.

An increase in Corporate Bonds

As illustrated in the chart above, the proceeds of the reductions have been largely reinvested into corporate bond funds. This is an area we have been exposed to in only a small way for a long time. A near 10% asset allocation shift in the Distribution Fund within a few weeks is one of the most significant switches we’ve done in the Fund’s history as we usually tend to phase in and out of positions gradually. This reflects the extent of the opportunity.

One of the funds used to increase exposure to corporate bonds was an old favourite, Schroder Strategic Credit, a fund that had been sold in recent years as the asset class became increasingly expensive, and we didn’t feel spread levels or absolute yields offered sufficient compensation for the credit risk. The valuation opportunity has become compelling following the rapid market sell off in February and March, with spreads now compensating investors for default levels never seen before.

The case for active management

We have long extolled the virtues of active management and never has this been more relevant than during this crisis. Being able to speak to the best fund managers in their asset class and gain immediate knowledge of the dynamics at play has been invaluable in helping us navigate this stormy period and make informed asset allocation decisions such as that described above.

The ability of active managers to add value has never been more important after the long bull market for passive investing and we are confident that the experienced managers in the funds and trusts we own are well placed to excel.

Engaging with the boards of investment trusts

Finally on the subject of investment trusts, we have always taken our duty as stewards of our investors’ wealth seriously and have regularly engaged with directors and managers of the trusts we own. However, at times like this, we are increasing our scrutiny when we feel the relevant interested parties can do more than just wait for their trusts’ wide discounts to narrow back to pre-crisis levels.

Measures such as share buybacks, increasing communication with existing shareholders and a marketing push to new investors are more important now than during the benign conditions of recent years. In our next note, we will focus on how we have been engaging with trust boards, managers and brokers, as well as the lessons we continue to learn from the sector.

Positioning for an uncertain outlook

The ultimate impact that the coronavirus will have on the world is currently highly uncertain, and whilst we are seeing the tentative signs of action plans for reversing lockdowns, the process will be long and subject to bumps in the road and possible reversals should a second wave of the virus contagion occur. Amid these uncertainties we have sought to make the Funds more robust in case of further falls but also to maintain sufficient exposure to attractively valued investments. The balance of seeking to protect capital in the short term while investing for long term real returns has never been harder.

We finish this note with a big thank you to all our investors for your support in this tough environment as we all face the challenge of ensuring the safety of our loved ones while also maintaining a clear head in managing your investments. We are very grateful for the additional investments during recent weeks that have seen the assets in our three funds rise to £415m, which exceeds the pre-crisis levels – a humbling experience that we do not take for granted. We are as determined and as focused as ever to deliver good outcomes for all our clients (including the fund managers, our families, friends and colleagues). We are always happy to talk to investors on the phone or via online video calls so if you have any questions, please don’t hesitate to get in touch.

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA 3830