16th August 2024

As regular readers will know, investment trusts play a crucial role in our Funds, providing access to a range of less liquid alternative asset classes, whilst also offering trading and engagement opportunities around share price discounts in what is an often inefficient market. Both factors provide investors with the opportunity to harvest differentiated and idiosyncratic sources of return.

Our investment trust ‘risk budget’ has in recent years been used primarily to gain access to alternative asset classes like infrastructure, renewable energy and song royalties where the underlying assets typically exhibit limited economic sensitivity and negligible correlation with mainstream financial markets. In an environment of expensive equities (at the index level anyway) and low interest rates these sorts of investments have particular appeal, both from a returns perspective and a diversification one. These less liquid investments can’t or shouldn’t be owned via open-ended funds with the fixed capital nature of the investment trust structure the perfect vehicle that allows a broader range of investors to access these types of assets.

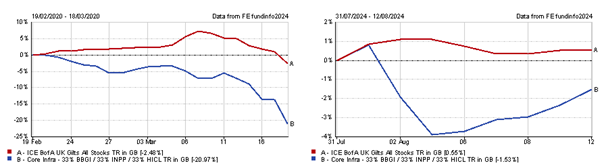

All good so far. We are not so myopic however, to think that investment trusts are a one-way street and recognise the potential tensions that come with a structure where the underlying assets might be defensive and uncorrelated, but where the liquidity advantage offered by investment trusts means those assets by necessity come in an equity wrapper. We’re also aware of how during times of market stress, correlations tend to gravitate towards 1, with the volatility of the past few weeks being a timely reminder of how alternative investment trusts can get caught up in a broader, indiscriminate equity market sell-off. The sceptic’s obvious question then is what is the point of owning these alternative, non-cyclical investments when investors are actually exposed to the investment trust share price whose tendency to deviate from net asset value (NAV) is most stark at times when the diversification benefits of the underlying assets are most valuable.

Whilst since launch our Funds have exhibited significantly lower volatility than their respective peers as well as lower downside capture, they do occasionally underperform in short-sharp drawdowns such as Covid and the recent sell-off, which can come as something of a surprise to some of our investors. This in large part is driven by the above dynamic and the tendency for investment trust discounts to widen during times of stress and indiscriminate selling, even if the underlying assets are unaffected by the turmoil. As custodians of client capital we are acutely aware that there is a pay-off between liquidity, risk and return and have to make an assessment over whether or not potential short-term volatility and underperformance is a cost worth paying in pursuit of harvesting what we expect to be superior returns through the cycle.

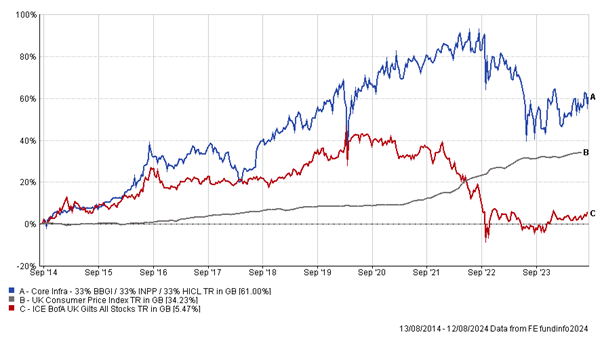

Informing this important decision is the longer-term time horizon we adopt and also the way we think about risk where we believe the probability of permanent destruction of capital is a far more meaningful measure than statistical volatility. Comparing core infrastructure investment trusts like International Public Partnerships, BBGI Infrastructure and HICL Infrastructure with UK government bonds is informative and helps bring our decision-making process alive. The core infrastructure trusts have inferior liquidity to UK government bonds, and all underperformed gilts in the aforementioned equity market selloffs as a result of discount widening. They also have some asset specific risk, but beyond that the risk profile is not a million miles away from that of sovereign bonds with the underlying cashflows typically generated from long term, government backed contracts. Dividend yields of between 6.1% and 6.6% currently offer an attractive 200bps spread over 20-year nominal gilts whilst partial indexation within the contracts means we are making an apples and pears comparison of progressive dividends with fixed coupons. The yield premium offered by the core infrastructure trusts over real yields as per index linked gilts is materially wider again (well over 500bps!).

Importantly the Boards of alternative investment trusts are increasingly cognisant that they need to do all they can to better align the share price experience with that of the NAV, with many selling assets to validate valuations and to return capital to shareholders. Even without this important development we still think an allocation to core infrastructure and other alternative investment trusts makes sense, with the premium returns on offer more than compensating investors for the additional volatility and any potential short-term underperformance. We’re also comforted by the fact that alternative investment trusts tend to recover and re-rate as rationality returns to markets, not to mention the broader risk return profile of our Funds where high levels of diversification and our margin of safety approach to investing has resulted in attractive capital preservation characteristics.

“Charlie and I would much rather earn a lumpy 15% over a smooth 12% return” famously once said Warren Buffett. Whilst the return prospects might be different, we fully endorse this mindset and would remind investors that embracing volatility is a necessity in generating investment returns. We think this is particularly relevant for alternative investment companies, which will at times exhibit equity market beta, but where risk is ultimately backstopped by the defensive nature of the underlying assets. The below charts, hopefully speak a thousand words, demonstrating that short term volatility is a price worth paying in pursuit of delivering positive real returns for clients with that being especially the case where the prospects of permanent destruction of capital are low.

Ben Mackie – Senior Fund Manager

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC24216.