I have never been given much credit for the investment decision I am most pleased with, mainly because almost no one knows I did it. In the mid-2000s I kept a former employer out of Sportingbet.

They did online sports betting and internet poker and were a relatively early internet success story. In late 2003 Sportingbet shares were 30p. In early 2005 they went over 300p. They peaked at just under 450p in early 2006, valuing the company at just under £2bn. Everyone was excited.

I was a young analyst at Sarasin and had a meeting with the CEO, sometime early in 2004. The broker invited me out to a live poker club one night. They paid Caprice to host the evening and she joined the tables for a while. I won a prize and met her briefly. The next day the broker called to ask about the size of our order and couldn’t hide his disappointment when I said there wasn’t one.

Fear of missing out is real, but there was always a troubling catch with Sportingbet. What they did was illegal in the US. I felt the odds were against us here, but the stock went up over 10x without me. All the sell side had it as a buy. I would ask if they felt there was an issue that the entire business was illegal in the US. I asked the CEO the same thing. No, they all said, it will be fine. Sportingbet are lobbying to get the law changed. Something will turn up. It will get sorted out.

History tells its own story. In September 2006 the Chairman made the extremely poor decision to take a family holiday in the US and was arrested coming off the plane.

The shares were initially suspended but fell 40% when they reopened. They fell over 90% in total from the peak down to 40p at the end of 2006. The US had been 62% of its revenue. They sold the US business for $1 in October 2006 after further legislation was passed, making it more, rather than less illegal.

Facts and evidence matter, especially when you are inexplicably under to pressure to ignore them or pretend they don’t exist. If you go to Sarasin today I doubt anyone will remember the time they didn’t buy Sportingbet, but it has always stayed with me.

I have been reminded of Sportingbet over the last 12 months or so. UK equities, particularly small and mid-caps have looked cheap for some time, but it hasn’t felt like a popular trade. The UK is down to 4% of global equities and outflows have continued.

On the other side, every time I turn round it seems Nvidia has had a daily move equivalent to the GDP of a medium sized country. It increased in size by $218bn in one day following results the week before last. That’s about the GDP of Greece. Its market cap just exceeded the entire German stock market.

There are few certainties in investing, maybe even none at all. Sometimes I think people mistake what we do as trying to guess the future. I don’t see it that way. No one is doubting or denying the impact of AI. I’m sceptical about putting a dollar amount on the future value of it on a daily basis through the Nvidia share price. It looks hazardous to me.

I think that in an uncertain world, we are trying to collect as much evidence as possible about what we can see, to give ourselves a better chance of a positive outcome a higher percentage of the time.

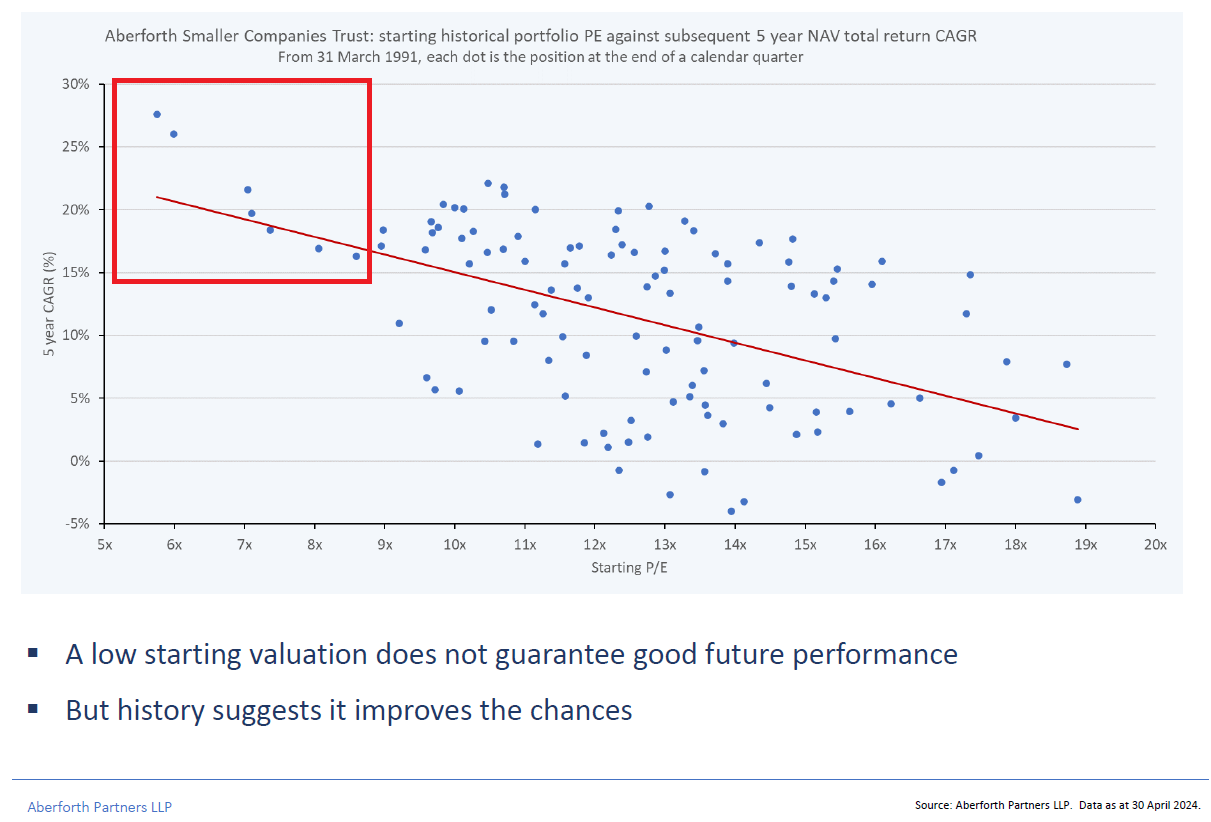

This brings me to the following chart from Aberforth, a UK small cap value fund which has been going for over 30 years. It shows the starting p/e valuation along the bottom and the following 5 year returns up the y axis.

I am especially interested in the top left (the red box has been added by me). The valuations don’t get this low very often, but when they do the next 5 years have historically been good. Even the bottom right is a less reliable guide. Stocks can start expensive and stay that way, or still produce a return for many reasons, as you can see at the moment in other parts of the market. You just have less favourable odds if you start over there.

The most recent p/e they gave for the fund was 6.9x late last year. Both the shares and the index p/e have risen since then, so I would estimate the p/e is higher than that today, but it would still be on the far left of the chart.

As Aberforth themselves point out, there are no guarantees, but I see this as a key part of what we are trying to do. I don’t see that this is an opinion on the UK or Aberforth. I see this as evidence that if we start here then there is a better chance of a positive outcome if we are patient enough over the coming years.

Online sports betting didn’t become legal in the US until 2018 though many states still don’t allow it. Online poker remains illegal today in all but a handful of states. Nobody could have credibly claimed to foresee this future in 2006, but you didn’t have to. Everybody knew it was illegal at the time.

Robert Fullerton – Senior Research Analyst

FPC24154

All charts and data sourced from FactSet

Hawksmoor Investment Management Limited is authorised and regulated by the Financial Conduct Authority (www.fca.org.uk) with its registered office at 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. This document does not constitute an offer or invitation to any person in respect of the securities or funds described, nor should its content be interpreted as investment or tax advice for which you should consult your independent financial adviser and or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. The editorial content is the personal opinion of Robert Fullerton, Senior Research Analyst. Other opinions expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represent the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. Currency exchange rates may affect the value of investments.