It is Monday morning. I am tired and grumpy, and it is raining. The temptation to unburden myself of what I really think about the State of affairs is close to irresistible. But resist I must. Most of all, because all of you are almost certainly in exactly the same boat. Who wants to read yet another load of self-righteous pomposity about the mind-boggling idiocy at the heart of our crumbling democracy? Suffice to say, thirty-nine years after first reading Romeo and Juliet, for my English Lit O-Level, I understand Mercutio’s curse.

I did Othello and King Lear for my A-Level. The analogies are just too easy. So let us move on and simply admire the world-class flouncing and indignation from all.

Tomorrow I have the pleasure of speaking at a seminar at the Stock Exchange to promote the merits of investment in the Alternative Investment Market. We (and five others) have the opportunity to showcase our wares and expertise to an audience of financial advisers, It should be fun and genuinely informative.

My message is, I hope, straightforward. Those using property relief as part of estate planning have a choice of three options. First, there are artificially and specifically created private businesses, usually making alleged low risk loans. We can all make our own judgement of the legitimacy of these.

Second, there are a number of long-standing and quite large players investing in AIM stocks. By the nature of their size, these firms should be investing in the largest and most liquid stocks on AIM. This carries dual risk. On the one hand, it is this very demand that has driven many of the largest AIM stocks to valuations that defy rational analysis. On the other, if they choose not to follow the liquidity, they must be buying into positions from which they will be unable to extricate themselves when the do-dah hits the fan.

Which leaves a third option: the smaller players, of which we are one, fishing at the smaller end of the market. We are trying to create portfolios of quality, British smaller companies that stand up on their own merit.

All options will currently, potentially, provide a degree of relief from inheritance tax. The use of property relief, though, seems always to carry the fear of a change in legislation. And we constantly ask ourselves, in the event of a change of thinking by government, which of the three options carries the least risk to the wealth of the investors?

In the first scenario, you have an investment in an illiquid private business, with minimal returns and no foreseeable exit. In the second, you hold a portfolio of over-valued stocks, with prices driven up by demand for a tax relief that has just been taken away. That looks a one way bet to us.

But in the third scenario, the investor has a portfolio constructed to stand on its own two (actually twenty-five) feet, regardless of the potential tax relief. Yer pays yer money and takes yer choice, but there has to be a place in this market for the way that we do it.

We are overdue a round of Roadshows and are back out presenting again in early and mid-October. If you thus far escaped an invitation from Jill, please just get in touch, we would love to see more of our readers in person. We are at all our usual venues across the south, south west and London; but this time have two additional stadium gigs in Norwich and Colchester.

No matter what happens between now and then, we shall have some fun. Regardless of the state of British politics, there is so much else that is being glossed over at the moment.

The theme for the Roadshows is how the world is ‘on the threshold’ of a number of dynamic and generationally important changes. We will cover, for example, why Paris 2015 is being betrayed globally by lip-service policies globally. What happens when we get past a climatic tipping point? What will it mean to have negative bond yields as the norm? Why is so much of twentieth century economic wisdom under threat? What does Hong Kong really mean for China, and for global trade? What are the real lessons of Woodford, for star managers, for liquidity and for the retail investor? Why ESG – love it or loathe it – is going to become part of your, and your clients’, daily life. Surely we can tempt you along? We are, as Smashie or Nicie would have put it, CPD-tastic.

It was HP Sauce last week. Today: first recorded by a Buddy-less Crickets in 1959, which now topical ditty was a hit for The Bobby Fuller Four and The Clash?

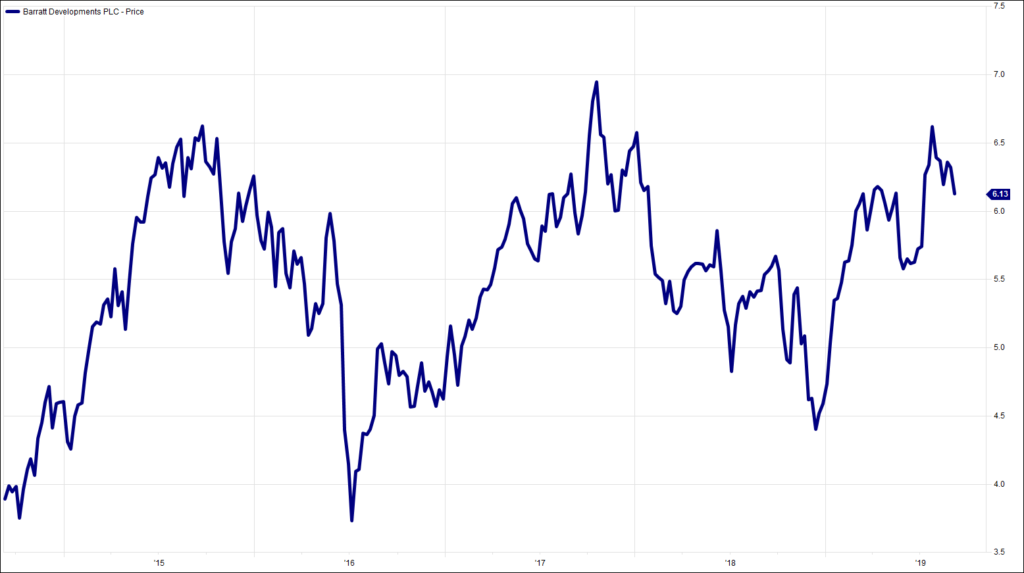

Chart of the Week:

Barratt Developments, past 5 years. A Brexit stock doing fine.

HA804/226

All charts and data sourced from FactSet

Jim Wood-Smith – CIO Private Clients & Head of Research

Hawksmoor Investment Management Limited is authorised and regulated by the Financial Conduct Authority (www.fca.org.uk) with its registered office at 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. This document does not constitute an offer or invitation to any person in respect of the securities or funds described, nor should its content be interpreted as investment or tax advice for which you should consult your independent financial adviser and or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. The editorial content is the personal opinion of Jim Wood-Smith, CIO Private Clients and Head of Research. Other opinions expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represent the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. Currency exchange rates may affect the value of investments.