7th February 2025

The investment trust sector airwaves have, understandably, been dominated by Saba with their stake building and requisitions prompting swift condemnation from Boards and brokers, belated efforts to mobilise retail investors, ‘standstill agreements’ and proposed new articles to place greater scrutiny around the appointment of directors and management teams. We have written extensively on the matter, with our strong feeling being that regardless of your view on Saba’s methods and motivations, activists are generally healthy for the sector and are only exploiting an opportunity that perhaps wouldn’t exist if there had been a more pro-active approach to addressing sector discounts in the first place.

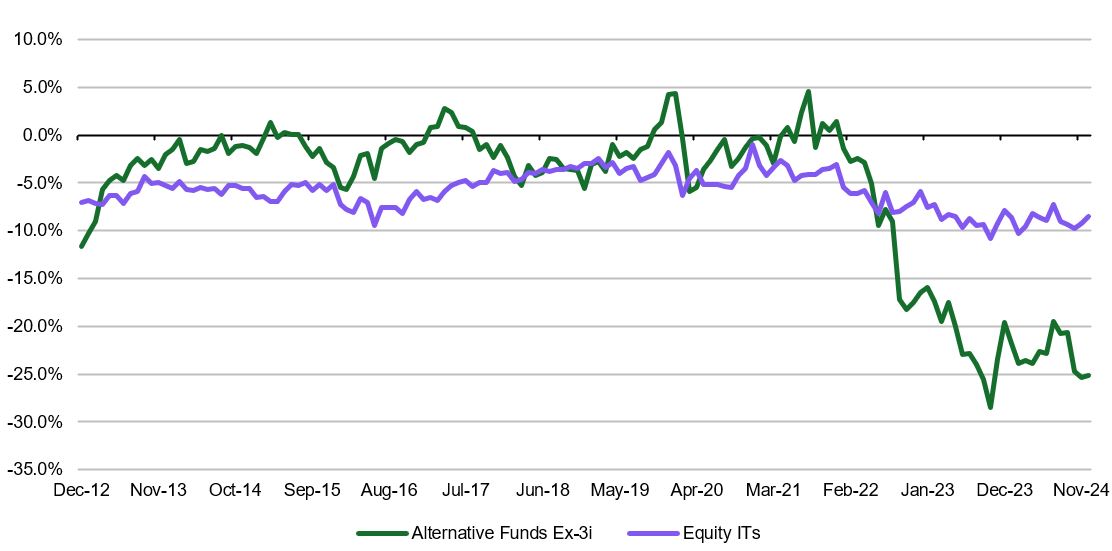

Saba’s efforts are primarily focussed on conventional equity investment trusts where it’s easier to hedge the underlying portfolio and isolate the discount arbitrage opportunity, and where more liquid portfolios give greater scope for a manufactured cash exit in the event their resolutions are voted down or a change of mandate if successful. But what about alternative investment trusts where the widening in discounts in the past few years has been much more extreme than that seen in conventional trusts? For the aforementioned reasons, we would not expect traditional arbitrageurs to play in this space, but that doesn’t mean existing shareholders shouldn’t be engaging with Boards to try and address what have become firmly entrenched discounts.

Source: Panmure Liberum, December 2024

Being curmudgeonly boring types, we spent the run up to Christmas speaking with the Boards of all the infrastructure and renewable trusts we own. In fairness most are already thinking more deeply about capital allocation with many pursuing asset disposals and using these proceeds or excess cash generation to deleverage and buy back shares. The impact on share prices have not been what Boards were hoping for, however, with discounts generally moving in the wrong direction, even in cases where disposals have come at NAV validating prices. We wonder, therefore, if more drastic action is required and question whether there is adequate recognition that the factors weighing on the alternatives sector might be more structural in nature than cyclical. Wealth manager consolidation, multi-asset fund outflows, cost disclosure issues and the scarring effect of share price volatility and a few abominable blow-ups have seen a large cohort of traditional buyers retrench from the sector. Hopes that a fall in risk free rates will see them stampede back in seem a little complacent to us.

Some possible options for less liquid alternative investment trusts to consider include:-

- Consider disposals below carrying value: Particularly when share price discounts are wide and buybacks especially accretive. GCP Infrastructure recently announced the sale of two operational wind farms at a 12% discount to NAV and the shares rallied, proving ‘perfect shouldn’t be the enemy of good’. With some valid questions regarding the depth of buyers for certain assets, Boards should be willing to ‘take-down’, especially when considering returns through the lens of IRR.

- Increase cadence and intensity of buyback programs: Although most infrastructure and renewable trusts have instigated buybacks, the quantum as a proportion of issued share capital has generally been underwhelming. Upping efforts might require renewed authorities and might not necessarily drive share prices higher but makes sense from a capital allocation perspective when discounts are wide, particularly when considering the typical single digit returns the underlying assets are expected to generate. Buybacks may also help clear overhangs and recycling of the register which is of particular importance for investment trusts where certain large wealth managers dominate. Ultimately, trusts and the sector as a whole have to be prepared to shrink to grow.

- Discount triggered contingent continuation votes: Some have them, but many don’t. We often hear from Boards that whilst they understand our request for buy backs, there exists a constituency of investor which worries about the impact of shrinkage on scale and liquidity. A continuation vote, notwithstanding widespread apathy, gives all shareholders a voice.

- Consolidation, managed wind downs and take-privates: In a world of wealth management consolidation and centralised buy lists there are far too many sub-scale alternative trusts, especially in the renewables space. Do we really need 3 UK solar funds? Corporate activity in conventional trusts and REITs has ratcheted up in recent years but remains far more subdued within infrastructure and renewables. Admittedly more disparate portfolios and shallower end markets present barriers, but these shouldn’t be assumed to be insurmountable.

- Mandate rethink: Static portfolios of operational assets are particularly vulnerable to ‘bond proxy’ labelling and higher risk-free rates. Whilst moving out the risk curve would be unpalatable for some trusts (think core infrastructure where the defensive nature of the assets is part of the appeal), there might be scope for some trusts to alter the mandate to one where NAV growth via portfolio recycling, development assets and active management might be possible.

- Finding new buyers: With traditional buyers in retreat, it is important to find a new constituency of investor. Easier said than done perhaps but it would be good to see Boards proactively considering their options in this regard. We know some are looking at DC pension schemes and potential index inclusion, whilst some are considering the provision of more operational metrics alongside NAV to try and appeal to generalist investors. We sense that these Boards are very much in the minority, however.

We accept that these suggestions each have their own contentions and that there are no silver bullets to address the discounts that currently plague the alternative investment trust sector. The status quo, however, is untenable and there needs to be more creative thinking in coming up with solutions. In the meantime, we think it’s important that investment managers share some of the pain and are better aligned with shareholders. We have argued elsewhere for fees based on market cap and are encouraged that trusts like Greencoat UK Wind and Supermarket Income REIT have shifted to this basis. Incredibly, some are still feeing off gross assets, including larger trusts where the arguments regarding the risk of diminished resource at the investment advisor lack credibility. The opaque nature of DCF driven valuations make the case for market-cap based fees all the more compelling.

We make heavy use of alternative investment trusts in our Funds and love the access it gives us to less liquid underlying assets. We are also enthused by the huge value on offer which we see as generational in nature. Unlocking this value, however, will require more hard work on the part of all stakeholders. For our part we will continue to engage constructively with Boards, who generally speaking ‘get it’ but probably need to intensify efforts in what, at the risk of hyperbole, is an existential moment for the sector. Shareholders absolutely have their part to play, and we encourage conversations and collaboration as we hopefully move forward through a period of great frustration to one where we can harvest wonderful returns and see the sector on a much sounder footing.

Ben Mackie – Senior Fund Manager

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC25275.