Readers will be familiar with my regular attempts to disguise my fear of the rate at which I am ageing by appearing to celebrate past times behind. Today, I proudly boast that I passed my Latin O-Level (first go) in the same year as the Iranian revolution and the introduction of the ironically named Happy Meal.

My Latin teacher was a genuinely terrifying man by the name of Dr Christopher Stace. Think Snape, and then make it eight times scarier. I met him again on a train many years later and learned that the impressions of a fourteen year old can be terribly wrong: he was utterly charming.

I am waffling. I am merely setting the scene for a non sequitur of monumental proportions. Let me quote from last week’s press release from the Federal Open Markets Committee: “Information received…indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months and the unemployment rate has remained low.”

So quite how do we get from that piece of benign scene-setting to “the Committee decided to lower the target range for the federal funds rate”? It is quite a challenge. The official explanation of this apparently dislocated logic is “the implications of global developments”.

What we have, therefore, is an American economy ticking over really rather nicely. There is no visible threat from inflation and the Central Bank is demonstrably prepared to act at the merest suggestion that President Trump is a little colicky. Sorry, I mean the merest suggestion that the economy may slow.

To financial markets that, arguably, long ago gave up on the relevance of valuation, this is music to the ears of the converted. The markets are driven by narrative, by smoke, mirrors and stories as tall as the Burj Khalifa.

It is not the toughest job of the week to explain why the S&P 500 Index is trading at its highest level ever. The Fed has cut, China is about to sign a trade deal, company earnings growth could be worse, Google has a quantum computer, al Baghdadi is dead and Washington won the World Series. What, as they say, can possibly go wrong?

The flotation of the world’s largest company is not something that we should allow to pass by without a superficial soundbite or three. The float has been dragging on for an eternity, but it does at last look as if Saudi is going to start flogging off the family silver.

The potential riches of Aramco are such that you will remember the London Stock Exchange changed its listing rules in order to allow companies run by foreign governments. Saudi is not going to let that sort of power go, and has duly said that they will float in Riyadh; and that everyone else in the world can keep asking for the carrot of the second, third, and fourth tranches. It is so transparent.

What does it tell us that the world’s second largest owner of oil reserves (remember Venezuela has the most) is starting to sell the state oil company? Does Saudi altruistically wish to share its riches with foreign investors? Maybe it does.

There are alternative theories, with which you will all hopefully be familiar. The majority of these are based on the much-cited words of arguably the most famous oil man ever, the erstwhile Saudi Oil Minister, Sheik Yamani. No one is quite sure when he first said it, nor the precise quote, but that does not matter. His point was: that just as the Stone Age did not end because we ran out of stones, so the oil era will end not from a lack of the sticky stuff, but because we find a better way of creating power.

It is possible to argue that the flotation of the first teeny tranche of Aramco is Saudi’s admission that it has to do something different. It is partly decarbonization and partly that the costs of creating power from non-hydrocarbon sources are falling dramatically; to the point where it makes simple economic sense, let alone climate sense, to invest into alternative, renewable power.

It would be nice to think that this was the logic behind the government’s weekend decision to mothball fracking in the UK. If it was, I missed it, drowned out by the risks of earthquakes in marginal constituencies. Allegedly.

Congratulations to those who spotted Reggie Maudling’s handover to Jim Callaghan from 1964. Something slightly more up to date this morning: what were John Cleese’s three basic differences between ‘we British and you Americans’?

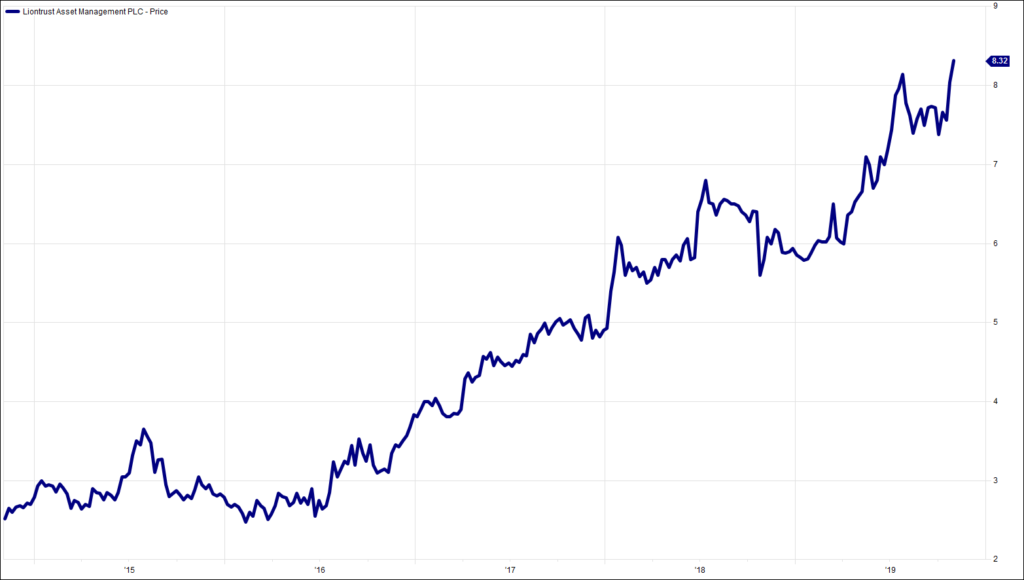

Chart of the Week:

Liontrust Asset Management, past 5 years. Roaring.

HA804/234

All charts and data sourced from FactSet

Jim Wood-Smith – CIO Private Clients & Head of Research

Hawksmoor Investment Management Limited is authorised and regulated by the Financial Conduct Authority (www.fca.org.uk) with its registered office at 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. This document does not constitute an offer or invitation to any person in respect of the securities or funds described, nor should its content be interpreted as investment or tax advice for which you should consult your independent financial adviser and or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. The editorial content is the personal opinion of Jim Wood-Smith, CIO Private Clients and Head of Research. Other opinions expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represent the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. Currency exchange rates may affect the value of investments.