It is an uncharacteristically bright Devonshire Monday morning. The Dow has closed above 28,000 for the first time and all is well in the worlds of high, medium and low finance. Though possibly not for those named and shamed at the weekend in Grant Thornton’s list of the most expensive Discretionary Fund Managers. As a member of the Royal Family may have said, ‘I have no recollection of those charges’. Indeed.

Enough of that. Let me instead try to enliven your week with a little rant about structured products. Over the past month or so we have been working with one of the handful of firms that may be denoted as structured product brokers on an ESG project. That is a huge simplification, so please indulge some elaboration.

You are probably aware that there has been an explosion in the number of indices that lay claim to being ‘ESG’. This is driven entirely by money, or specifically, fees. The investment industry has cottoned onto the previous gap between the two current dominant forces in the industry: passives and ESG. The solution is obvious: devise as many indices as you can with at least some token pretense of ESG-ness. Job done. Now everyone can track, at lower cost, an index with a slightly lower weighting in oil stocks than one without the alleged ESG overlay.

Box ticked. Never mind that the end product is ghastly. To be fair, I am sure that there are some very good ESG-tagged indices. It is just that I have not yet found any.

One side-effect of the development of the ESG Indices is the ability to build structured products around these. Whatever one wished to do with one or more of the usual equity indices – autocalls, defensive autocalls, boosters – can now also be done with an ESG index. This is a thoroughly good thing, just with the caveat of the flaws of the underlying index.

I promised that this would be a rant. So far, this may as well be the build up to the teddy bears’ picnic. So this is where it starts to be fun.

The product that we wanted (and now have) was a flat autocall on an ESG Index that doesn’t have too many oil, tobacco and polluting mining stocks in it. We found a decent enough index. It correlates well with broad European equites and the autocall coupon is slightly over 12%. That is very nice.

But it gets a whole lot better. The product is provided by Société Générale. The French stalwart of structured products is also a leading light in what we might call ‘green finance’. The bank has a project called ‘Positive Impact Finance’ and it is this that really floats our boat.

Under the initiative, Soc Gen will match the amount invested into the structured product with loans to positive impact projects. These may be climatic, or to support biodiversity, better healthcare or improved access to education.

What we get from our product is a tremendous double whammy, if you will excuse my sloppy language. The 12% coupon gives a huge tick in the investment box, plus this is a genuinely positive impact product. What is not to like about this?

Well, apparently quite a lot, according to our peers. How many of our fellow DFMs do you reckon thought that this was a good idea and that they should have a free piggy back into the product? Yes, you are right. None.

What have they done instead? It seems that the lure of a defensive autocall on another index with another bank was too strong. That product has NO (and no apologies for shouting) positive impact credentials. It is not a bad product, but it is just an autocall on an index with slightly less in oil and tobacco stocks than one without the ‘ESG’ bit.

What this is to me is a clear case of greenwashing, of tokenism. Given the choice, the majority have plumped for the product without tangible positive benefit. It is very disappointing and I think tells a story about how seriously, or not, sustainable investment is being taken.

Last week either the Yellow Pages adverts were too obvious for everyone, or else I won. Today, one to ponder on for the next three weeks: Dryden said there were 12, Walter Scott had 16, Monty Python a mere 7. What?

I now disappear to the Far East. Innovation will be back for one more issue before Christmas.

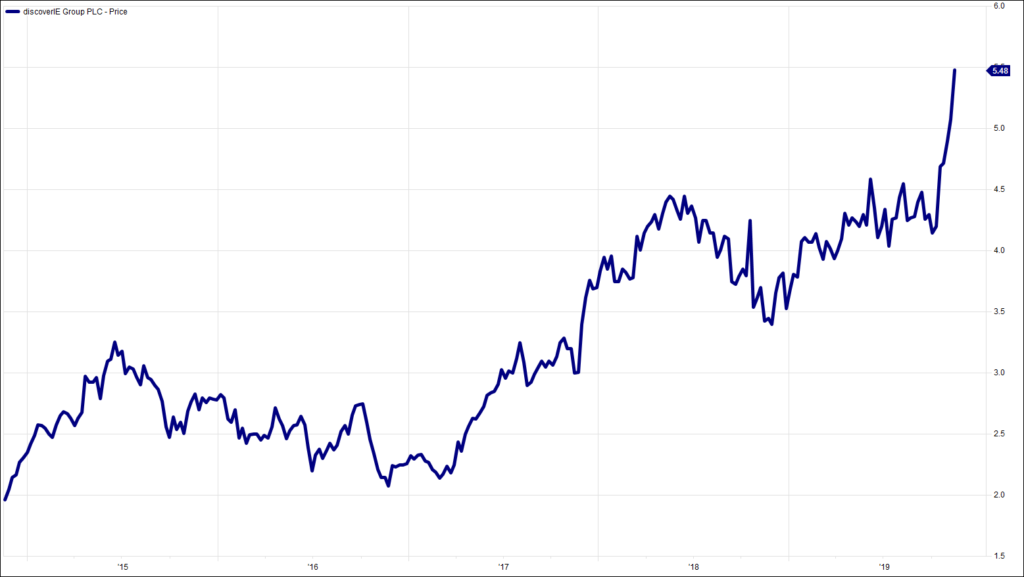

Chart of the Week:

discoverIE, past 5 years. Very popular.

HA804/236

All charts and data sourced from FactSet

Jim Wood-Smith – CIO Private Clients & Head of Research

Hawksmoor Investment Management Limited is authorised and regulated by the Financial Conduct Authority (www.fca.org.uk) with its registered office at 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. This document does not constitute an offer or invitation to any person in respect of the securities or funds described, nor should its content be interpreted as investment or tax advice for which you should consult your independent financial adviser and or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. The editorial content is the personal opinion of Jim Wood-Smith, CIO Private Clients and Head of Research. Other opinions expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represent the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. Currency exchange rates may affect the value of investments.