7th June 2024

The past two years have been very challenging for the investment trust sector. The rapid change in the cost of capital environment in the wake of the disastrous Truss/Kwarteng mini-budget, combined with the nonsensical change in cost disclosure rules for investment trusts have been monumental headwinds for the sector. Discounts have widened to levels not seen outside of deep-crisis periods such as the Great Financial Crisis in 2008 and the sharp Covid-19 selloff in 2020. We hear of many investors abandoning the sector entirely.

Despite these material headwinds, we believe having exposure to investment trusts is vital for building truly multi-asset portfolios. Investment trusts provide exposure to asset classes that you cannot or should not access through open-ended funds such as property, infrastructure, private equity, private credit, less liquid listed equities such as micro caps and more. These are asset classes that provide important diversification benefits to traditional asset classes like liquid listed equities and bonds which can be appropriately accessed through open ended fund structures. Not only that, but they provide performance enhancing prospects for multi-asset portfolios.

As well as the attractions of the returns of the underlying asset classes investment trusts provide exposure to, investment trusts also come with unique features which can enhance returns further. Features such as continuation votes provide investors with the opportunity to wind up investment trusts trading on discounts to net asset value, creating an additional source of alpha. Many offer tender opportunities at net asset value – the chance for investors to realise some of their investment at NAV if trading at a discount, another source of alpha. They come with independent boards of directors who can choose to spend excess capital buying back shares when trusts trade at a discount, to enhance NAV per share returns and help to address supply/demand imbalances in shares and narrow the discount.

The investment trust sector is a highly inefficient market. We have close relationships with the broker community and do all our own dealing between the four fund managers. This means we can quickly react to flows and take advantage of opportunities to pick shares up below the bid-ask spread when a forced seller comes along, or sell above the mid-price into strong demand. This contrasts with open ended funds when you always must pay the NAV.

All combined, and despite a very challenging 24 months for the sector, over the medium to long-term investment trusts punch above their weight in performance terms. Taking our Vanbrugh fund as an example, over the 10 years to the end of 2023 Vanbrugh averaged 29% exposure to investment trusts, but they contributed 36% of the returns. Honing in on the past 5 years, where the two difficult years for investment trusts have a bigger impact on the numbers, the 31% average exposure to investment trusts has still contributed 31% of the returns. So, despite the material headwinds faced, in performance terms investment trusts have still been meaningful contributors.

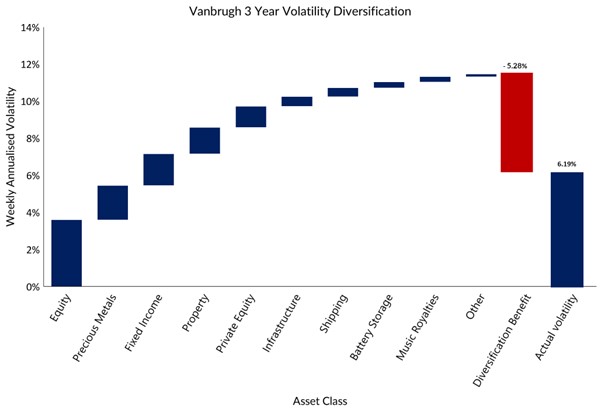

In addition, and just as importantly, the diversification benefits we get from using investment trusts in our portfolios cannot be overstated. The below chart shows Vanbrugh’s 3-year volatility diversification, with 2/3rds of the period represented by a tough period for investment trusts overall. Despite this, the delivered volatility of Vanbrugh has been 6.2% annualised. Taking the volatility of all the underlying positions over that period (with no diversification benefits), the volatility would have been nearly double!

Source: FE fundinfo, 31/12/2020 to 31/12/2023.

Investment trusts punch above their weight both in terms of both performance and diversification benefits they bring to our funds. Despite a challenging 2 years for the sector, we believe they remain as relevant as ever for multi-asset funds. We will continue to campaign hard to turn over the nonsensical cost disclosure issues the sector faces, and in the meantime keep buying well managed trusts trading on exceptionally wide discounts.

Dan Cartridge – Fund Manager

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC24157.