24th May 2024

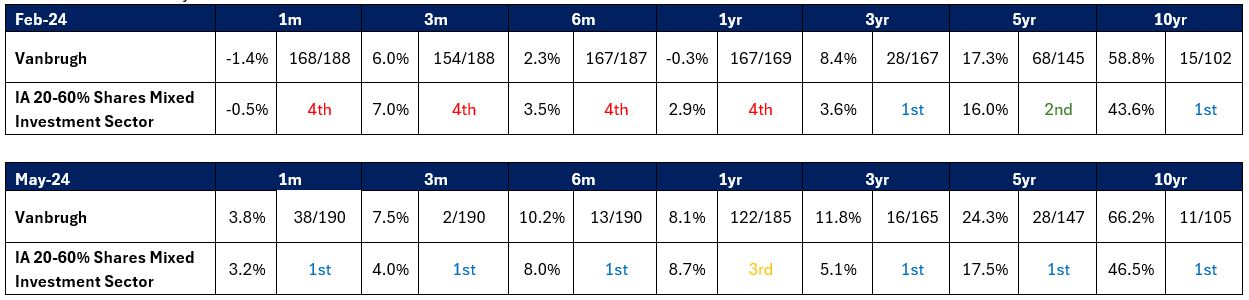

Way back in the depths of February, we published a blog titled ‘Darkest Before Dawn’, a gentle mea culpa scribed following a period of underwhelming returns in which we described an investment environment that seemed completely at odds with our style of investing. Fast forward three months and the sun is poking out from behind the clouds and Vanbrugh is back delivering top decile returns across most timeframes.

What a difference a day few months makes

Source FE Fundinfo 22/05/2014 to 22/05/2024

This is not meant to be a trumpet blowing exercise, but more a reminder (to ourselves as much as anyone else) of the vagaries of short-term performance and, more crucially, the importance of maintaining stoicism and emotional consistency against a backdrop of fluctuating and often impossible to control external factors. We are reminded of the Abraham Lincoln quote ‘This too shall pass’ which extols the idea that neither negative nor positive moments last indefinitely and that good and bad episodes should be treated with as much equanimity as possible. Stay hopeful and on your course in the dark days and don’t over celebrate the good. This is true of all human experience but seems especially apposite for those in the business of managing money, particularly in this day and age where our industry’s fixation with the short term and relative returns seems to be more intense than ever.

In our February missive we also, through admittedly knitted hands and clenched teeth, described the fantastic value embedded within our portfolios and resolved to stick to an investment process that whilst apparently malfunctioning, in the short term had delivered strong returns over longer periods (we often think the best time to buy a fund, including our own, is after a bout of poor performance). Having a philosophy you truly believe in and a process which has been implemented and honed over many years helps immeasurably in stiffening the spine and maintaining the confidence to stick to the proverbial knitting. Remaining solely focussed on the objectives of the Funds rather than how performance looks versus a disparate sector of peers is also helpful, as is a consideration of the long-term client outcomes the Funds have consistently delivered.

Level headedness, measured objectivity and trusting the process is particularly important for us, bearing in mind our valuation conscious approach often results in contrarian views and positioning that looks very different to that of most peers. Refusing to chase momentum and refusing to buy expensive things that keep going up and which everyone else owns can be a painful place to be. Looking in more detail at the driving factors behind our stark reversal in short term fortunes shows that it is unloved UK and Asian equities and overlooked discounted investment trusts that have done much of the heavy lifting. The latter include more esoteric areas such as shipping and song royalties which tend not to feature in great size in many portfolios and certainly not in passive ones. For those of our clients who use our Funds alongside perhaps more traditional solutions, the propensity for our portfolios to zig when others are zagging should be a valuable component in a blended approach and hopefully helps ameliorate the discomfort felt when our funds do experience those inevitable bouts of underperformance.

In the same way that we try to remain calm through periods of poor performance, it is also vital that we do the same during periods of good returns. Hubris is a dangerous characteristic for a fund manager as is falling in love with certain investments. Coming back to the first principles of our investment philosophy and thinking about individual investments with respect to valuation, margin of safety and the asymmetry or otherwise of pay-offs on an ongoing, clean sheet of paper basis helps ward off those temptations of overconfidence.

We’re extremely confident that we will endure more bouts of underperformance in the future as well as periods of strong relative returns. To paraphrase Kipling, we will endeavour to treat those imposters of disaster and triumph just the same and will remain focussed on trying to deliver on the objectives of the fund over the medium term in as consistent a way as possible.

Ben Mackie – Senior Fund Manager

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC24152.