18 February 2022

Vanbrugh’s 13th anniversary – the number 1 fund since launch.

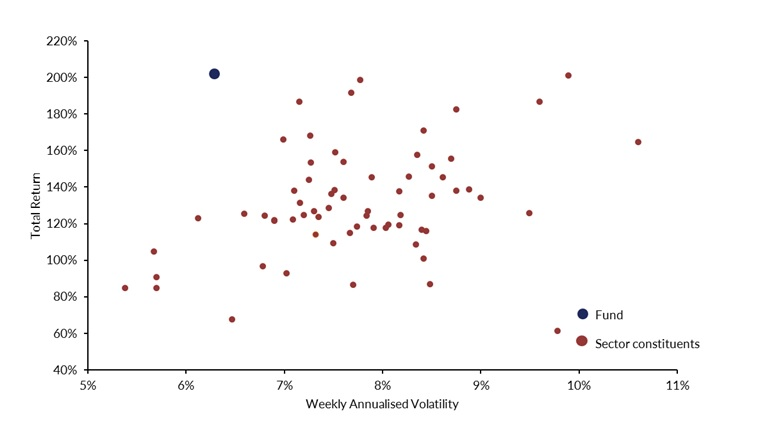

The Vanbrugh Fund becomes a teenager on Friday 18th February 2022 and it has had a good life so far. Not only is it the number one fund in its IA Mixed Investment 20-60% Shares Sector (I still call it the Cautious Managed Sector but that’s showing my age!), it has delivered this performance with the sixth lowest volatility in the sector.

Source: FE Analytics, 18/02/2009 to 31/01/2022.

When I presented this impressive performance to a potential investor recently, their first question was “How have you done that then?” While that is a quick and obvious question, it is quite hard to answer succinctly as there are a number of factors that have contributed to this result. Without wishing to compare us too much to the great Sir Dave Brailsford, who has done wonders for transforming British cycling from no-hopers to Olympic champions and Tour de France winners, there are some similarities to our investment philosophy with his famous ‘marginal gains’ theory.

Although we do not analyse whether we are wearing the right clothing or sleeping with the right pillows as Brailsford does among hundreds of other things with his cyclists, perhaps the main common element of the philosophies is the focus on the process rather than the outcome. Brailsford encourages his athletes to focus on their own training and constant progression, i.e. control the controllable, rather than be distracted by the competitors or the ultimate prize, so that if you do the right things to the best of your abilities, rewards will naturally follow. At Vanbrugh’s launch in 2009 we didn’t have a goal for it to be the number one fund, instead we trusted in our process that is built around our most important and constant belief that, as per Sir John Templeton’s observation, “The true objective of any long-term investor is maximum total real return after taxes.” All our investment decisions are made with this in mind, given this is what all investors really want. We believe this simple, but not easy, philosophy to be very different to what exists within many other fund management firms (Brailsford would call them competitors) where there can be a tendency to over-complicate things with various risk measures, benchmarks, and volatility targets, which can result in a loss of focus on what it is that clients ultimately want.

Having that client objective as the capstone (note the link with Hawksmoor’s architectural heritage!) to our investment philosophy, enables other elements of the process to naturally fit around it. The following are some of the key ‘marginal gains’ that we believe have collectively created Vanbrugh’s sector leading performance (the highlighted phrases could be used in a game of Hawksmoor bingo as we use them so often);

- Capacity constrained – ensure your competitive advantages of being active, nimble, and investing in less liquid parts of financial markets (such as investment trusts), are not diluted or hampered by running too much money

- Unconstrained asset allocation – truly multi-asset investing means looking beyond just equities and bonds, incorporating specific parts of the property and infrastructure markets, adding alternative asset classes like song royalties or shipping. Many traditional funds ignore these assets, perhaps due to their relative complexity or illiquidity

- Dynamic, valuation–led approach to asset allocation – valuations change over time leading to various assets becoming cheaper or more expensive. Therefore, it makes sense to adjust asset allocations, favouring cheap assets and shunning expensive assets. Having valuation at the start of any investment decision, rather than assessing arbitrary benchmark weights or historic volatility, creates our margin of safety in case we are wrong. It makes no sense to us to have static and permanent allocations to asset classes just because of how they have performed in the past

- Risk and volatility are often confused as being the same thing, but to us, risk is defined as the probability of a permanent loss of capital, and why we focus on valuations as the best way to mitigate from losing clients’ money. Sometimes the most volatile assets are the cheapest and can be the best time to invest (private equity in 2009, or European equities in 2011 for example), but many investment managers with volatility targets would be prevented from doing so by their internal ‘risk’ processes

- Our collegiate team approach creates a collective accountability for the investment decisions and ultimate performance of the Hawksmoor funds. We eschew the star manager culture, not just because of the fallibilities of one person, or the weight of responsibility on their single set of shoulders, but more importantly because if our funds are designed to meet the needs of investors’ long-term savings, then the funds should not have a finite life linked to one individual manager’s career. Succession planning is therefore a key factor in the management of the fund

- Finally, our self-belief in the funds and the process is reflected in our, and our families’, own significant personal investments in them, so that we share in the success and failings with our fellow investors. Whilst the amount of care and passion we have cannot be easily comparable to other firms’ funds, we believe this alignment of interests is a key additional part of the process that sets us apart

We are incredibly proud of what we have achieved in the 13 years of Vanbrugh’s life and that its investors have received sector leading returns, but we will not dwell on that success as we have an important job of delivering on that simple client objective of generating real returns after taxes (and charges) long into the future. Just as Brailsford’s cycling team is constantly striving to identify those marginal gains, we will continue to do that too by evolving and improving our process, which involves learning from mistakes (of which there are many!) to stay relevant to ever-changing market conditions. The process seems to work as Vanbrugh’s siblings, Distribution (turns 10 years old in April) and Global Opportunities are ranked in the top quartile of their respective sectors since they launched.

If we can stick to our philosophy that has served us so well in the past, then we hope Vanbrugh’s teenage years will be more pleasant than what we have experienced as parents!

Daniel Lockyer – Senior Fund Manager

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC109.