September 2020

Since our note on gold 3 years ago, the price of the metal in dollars has risen from $1,250 per ounce to over $2,000 and is currently trading around $1,900. Our exposure to the precious metals theme has been highly beneficial to our Funds’ performance, despite for a short period being unhelpful when it accentuated the setback suffered in March when gold fell along with almost everything else in a kneejerk flight to liquidity.

As we will explain in this article, we continue to believe the reasons for holding gold remain valid such that our level of investment in the precious metals complex (holdings in physical gold and funds investing in silver and gold bullions and their related mining equities) has increased with roughly 10% in each of the Vanbrugh and Global Opportunities Funds and 5% in the Distribution Fund.

Here we address the case for continued high exposure to this area, but first, we believe it is important to illustrate the various arguments put forward to explain the long- and short-term drivers of the gold price.

What moves the gold price?

Real Yields

In our last note, we alluded to the attraction of gold being enhanced when the rate of interest available on cash is low, especially after adjusting for inflation. Thus the prevailing levels of “real yields” (the interest rate over a given time period adjusted for the deleterious impact of rising prices) is seen by many as an important determinant of the direction of gold prices.

In most of the developed world, thanks to the actions of central banks, bond yields have fallen precipitously, and meanwhile expectations for future inflation rates have risen. This dynamic has resulted in negative real yields across many economies. A negative real yield signifies that the act of holding money in the form of low risk securities like government bonds will result in the erosion of the purchasing power of that money. This makes gold, which offers no yield at all, comparatively more attractive. In jargon, the “opportunity cost” of holding gold falls with falling real yields.

Speculation

On the other hand, some commentators have pointed out that the gold price has risen far too quickly recently and that this cannot be explained by movements in real yields. In a paper by Claude Erb, Campbell Harvey and Tadas Viskanta1, the authors argue that the price of gold in inflation adjusted terms is currently too high – i.e. it cannot be explained by merely appealing to the direction of real yields. They leave open the suggestion that the causation may run the other way, or that speculative demand for gold has recently increased, driven by the creation of Exchange Traded Funds (ETFs).

Currency debasement and increased liquidity

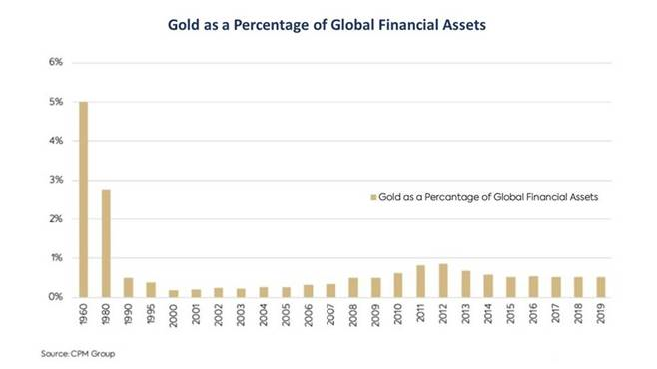

Meanwhile another framework looks at the price of gold in relation to the amount of money in circulation, or as a ratio against other financial assets (stocks, bonds etc). This argument runs that the more available liquidity (or money in circulation), the higher the gold price should be given new gold supply is highly constrained relative to the existing gold stock (you can’t print more gold!). Further, gold could be seen as “cheap” if its total market value is low as a percentage of the market value of other financial assets.

Source: Baker Steel 1960 to 2019

The impact of the US dollar

Many investors cite the inverse correlation between the US dollar and the gold price, falsely believing that a weak dollar automatically leads to a strong gold price and vice versa. It is important not to forget that gold is a currency. If the dollar is weak, and the gold price in US dollars increases, it does not automatically follow that when priced in other currencies like sterling or yen that the gold price has increased. A gold bull market is characterised by gold rising in terms of all currencies.

Rising government deficits

Periods of rising government deficits tend to lead to increased interest in gold. If investors believe that persistent government deficits, especially in the world’s larger economies, will lead to unsustainable levels of national debt then the only solutions available are either default (unpalatable for almost all governments) or the erosion of that debt in real terms – i.e. a government and its central bank may be forced into allowing (indeed even encouraging) a period of high inflation. If the interest it pays on its obligations is fixed, then rising inflation should allow it to manage its debt load more easily given tax revenues should rise with inflation. This should lead to falling real yields and is a good backdrop for gold to do well.

What is the case for gold in portfolios?

Similar to the case we outlined in our first piece, we believe the conditions for gold to do well have been in place for some time, and should continue for some time to come. Central banks globally have injected vast amounts of liquidity into economies either by printing money and purchasing securities, such as government bonds and recently even corporate bonds and other types of security from private institutions, or by the direct financing of government deficits through printing money and purchasing the bonds that a government issues to finance a deficit. The necessity to keep interest rates and longer-term yields low (to avoid the servicing costs of this debt increasing) has never been greater given the extent and persistence of government deficits which have only been exacerbated this year by measures to support economies in the wake of the COVID-19 pandemic.

Inflation has been persistently low for the past decade but recently expectations of future inflation have been rising, partly due to a massive increase in the available amount of money in circulation and partly due to central banks deviating from their historic mandates to keep inflation low, in favour of allowing it to run hot. Aspiring to higher inflation and achieving it are of course two very different things, but against this backdrop of shifting monetary policy, it is worth noting that over time gold has acted as a good store of wealth and has performed particularly strongly in periods of higher inflation.

There are a multitude of factors that influence the gold price, with sentiment and speculative activity especially prevalent in the short-term. This can result in bouts of volatility which may serve to deter certain investors. We acknowledge that it is hard to accurately predict the behaviour of the gold price in the short-run and so try and stay focused on the longer-term reasons for owning gold:

- an increase in the amount of fiat currencies circulating around the global economy (otherwise known as “debasement”) in contrast to the supply constraints gold faces;

- persistent and growing levels of government debt that increase the likelihood of this debasement, while ensuring prevailing yields available for money remain low. In other words, the “opportunity cost” of holding gold is likely to remain low for some time.

How do the Hawksmoor Funds express this view?

We have a valuation-led investment process, seeking to own assets that offer a margin of safety and/or diversification benefits to our portfolios. Whilst physical gold as a currency cannot offer a margin of safety, it is a liquid asset that bears no credit risk and one that has outperformed all major fiat currencies since the end of the gold standard in 1971, so a small allocation does bring diversification benefits to our overall currency exposure.

The tendency of bullion to attract safe haven flows during times of stress, and its long term negative correlation with risk assets such as equities, bring further portfolio construction benefits. The majority of our exposure to the precious metals complex, however, is via funds that invest in gold and silver mining companies, which can be easily valued, and where we can apply our disciplined investment process and identify a clear margin of safety.

Despite the very strong performance of these companies since our last note, they continue to offer very good value. Costs for these companies are not as variable as their revenue – the latter being a function of the gold price. Major costs such as fuel prices, wages and cost of extraction can vary, but profit margins can expand very quickly when the gold price rises.

Current valuations of gold miners imply a gold price some way below current levels. Meanwhile the rating that these stocks trade on (the price investors are willing to pay per unit of profit) remains very low indeed.

We thus have a potential double whammy of catalysts for continued strong performance from our Funds exposed to such companies. The longer the gold price stays elevated, the more quarters of strong earnings these companies will deliver, leading to price appreciation. If investors then determine that the quality of these cash flows is sufficiently high, they may decide that these stocks deserve to trade on higher ratings – i.e. they will pay a higher price per unit of these higher profits.

Indeed, in prior gold bull markets, the rating that these stocks commanded was several times higher than it is today. We suspect this is what has led the famous investor, Warren Buffett, to make his first foray into gold equities (an area he has hitherto always shunned) via a stake in Barrick Gold.

Mine closures, as a result of the pandemic, have meant the current strong revenue-generating environment has not yet been reflected in recent earnings announcements, but with mines now open, that should change and provide a potential catalyst for further strong performance.

Thankfully, the more disciplined governance at these companies that we highlighted in our note three years ago seems to show no sign of slipping. Management teams appear determined not to repeat the mistakes of the past by increasing capacity too quickly. This is resulting in higher cashflows being passed through to shareholders via higher dividends and gold miners now offer very attractive yields.

We concluded our 2017 note as follows: “at a time when most assets are highly valued, and it is hard to build diversified portfolios, we believe investors would be well-advised to consider the merits of gold funds. Indeed, we believe gold is one of the best ways of insuring against some of the most serious risks in the global economy and financial markets. Albeit, as with any insurance we hope it will not be required, but it is prudent to have it.”

This conclusion still stands, but today we view the gold mining sector as far more than just insurance: it is arguably one of the cheapest valued sectors in equity markets globally combined with a very strong underlying operating environment. We thus expect investment interest in the sector to continue to increase.

1Source: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3667789

Ben Conway – Director/ Head of Fund Management

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA4071