Defence is the best form of attack

Healthcare is one of the biggest sectors in the global market, and for long-term investors, we think it can also be one of the best.

It boasts some of the most innovative and exciting companies in the world, but it also has attractive defensive characteristics. Many businesses in the sector have high barriers of entry due to the stringent regulation, vast R&D costs, specialist nature of the work, and natural economies of scale. One thing that all in the sector have in common is the tailwind of an ageing demographic and constantly evolving care needs.

Below, we evaluate some of the latest advancements and discuss the more established parts of the sector.

Chart 1:Healthcare Industry Sectors

(Source: Hawksmoor Research)

Masks on

Whilst the impact has been widespread across sectors and geographies, it would be wrong to write an article on Healthcare and not address the elephant in the room. That’s the challenges and opportunities that Coronavirus has presented. For many, the pandemic meant a switch to working from home and lockdowns, though for those working in healthcare it was quite the opposite.

Hospitals had to adapt to increased safety protocols and an overflow of C-19 patients, whilst providing continuing care to others. This added to continued pressures such as staff being pushed to the limit and equipment shortages. Beds were prioritized to Covid patients, meaning those in the waiting line for elective surgeries were made to wait a while longer. That has created a major backlog. Similarly, big pharma prioritised fighting the pandemic, deploying

scientists and R&D budgets to finding a vaccine. The likes of Pfizer, Moderna, and AstraZeneca were originally doing business at cost, but are now starting to make positive returns on their vaccines.

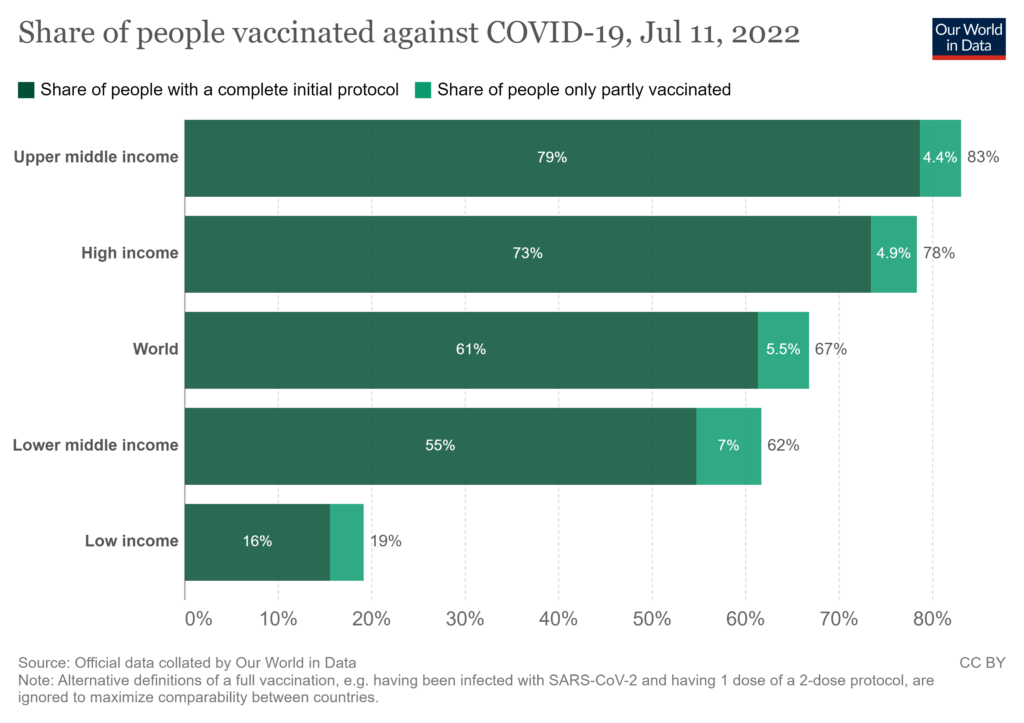

The pandemic has unveiled cracks in healthcare systems and highlighted the dispersion of quality of healthcare, particularly between developed and developing economies (See below Chart 2). That being said, the aforementioned backlog and the potential for increased returns from Covid treatments are just two reasons to be positive on the sector. We’ll come back to these later. First, we evaluate perhaps the most exciting dynamic in the wider sector – the rapid technological change.

Chart 2:Share of people vaccinated against COVID

(Source: Mathieu, E., Ritchie, H., Ortiz-Ospina, E. et al. A global database of COVID-19 vaccinations. Nat Hum Behav (2021))

Evolving technology

Innovation continues to drive the world forward, and some of the most revolutionary technology is being developed within healthcare.

Where possible, the typical model of visiting a doctor is making way to telemedicine, the act of using technology to deliver care from a distance. The telemedicine market is projected to grow from $90bn in 2021 to $636bn in 2028. That’s a compound annual growth rate (CAGR) of 32.1%. There are many benefits. As well as dramatically improving access to care, telemedicine should boost the accuracy of diagnoses and drive efficiency too. A move from outpatient to inpatient visits saves both time and vital resources.

It’s a similar story in other parts of the sector. Genomics could also bring material positive change through technological progress. For example, there is potential for gene sequencing to highlight traces of cancer and use a gene editing platform to reprogram the patient’s immune system to attack the cancer cells. Hence switching the focus to prevention of diseases as opposed to fighting them. The global genomics market is expected to grow at a CAGR of just under 20% to 2028, according to Fortune Business.

Whilst the ideas above are new, exciting, and potentially transformative to modern healthcare, the technology is far from established. Investing in these type of stocks is potentially very lucrative, but usually brings added risk. Early stage biotech companies can have higher costs due to the extensive R&D required and the time taken to develop solutions. Those solutions then must hurdle regulatory roadblocks, with approval or denial likely to make or break a company.

Therefore, we believe investors are generally better gaining exposure through an actively managed fund. That management comes with extra costs, but we think the benefit of a diverse portfolio managed by specialist teams brings a worthwhile benefit

Safety in Pharma

Established pharmaceutical businesses offer a different proposition for investors. While there are specialists like insulin producer Novo-Nordisk, generally large pharma businesses such as Roche, Novartis and AstraZeneca have significant internal diversification by virtue of having many drugs in production. This is therefore an area ripe for direct investing.

Drugs are complex to produce and develop, and once approved are protected by long-term patents. That improves visibility over the top line. Once drugs come off patent, the formula becomes available to generic producers. This means profits quickly disappear. It is therefore important to have a pipeline of potential new blockbuster drugs for regulatory approval, or an effective M&A strategy. Buying in growth is commonplace in the pharma industry.

There will always be companies at different stages of the patent cycle. Novartis and AstraZeneca, for example. The former faces patent expirations in the coming years, and so trades on just 13x forward earnings. The latter has a more exciting pipeline and so trades on a more demanding 18x forward earnings. We are supporters of both businesses, which highlights how there is both value and growth to be found within the sector.

Opportunities in Medical Devices

As the healthcare sector evolves, so too does the equipment used. Safety is, of course, the number one priority. Those developing new medical devices are looking to improve patient and hospital outcomes.

The pandemic meant elective surgeries dipped as available beds and resource were instead allocated to C-19 patients. Add in recent inflation, and many across the sector have seen their top line slow and margin squeezed.

That being said, fortunes are beginning to turn. Stryker, an innovative US business that has developed a robotic surgical arm that can be used for joint replacements, recently said elective surgeries have returned to pre-pandemic levels. That means the group is running with a record order book as it looks to catch up with demand. Valuation is appealing too, at just under 20x forward earnings compared to a five year average of 24x. It trades at a slight premium to peers, though has proven to be more resilient through the pandemic, is a high-quality operation, and is set to benefit from an improved market backdrop.

Conclusion

Whilst there are lots of exciting and potentially revolutionary trends emerging in healthcare, from an investment perspective it is best to stick to the basics. We have options on the funds buy list, including in the area of biotech. Our direct equities team sticks to the established, larger companies which offer valuable defensive characteristics as well as structural growth. We see good opportunities within Pharma, and believe Stryker is an attractive option too.

Ben Luck – Investment Analyst

Health Warning/ Disclaimer

This document should not be interpreted as investment advice for which you should consult your independent financial adviser. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation. They are subject to change. Past performance is not a guide to future performance. Hawksmoor Investment Management Limited (“Hawksmoor”) is authorised and regulated by the Financial Conduct Authority. Hawksmoor Investment Management Limited is registered in England No. 6307442 and its registered office is at 2nd Floor, Stratus House, Emperors Way, Exeter Business Park, Exeter EX1 3QS. FPC412

FOR PROFESSIONAL ADVISERS ONLY AND SHOULD NOT BE RELIED UPON BY RETAIL INVESTORS