Our job involves not only allocating to asset classes, but also to managers. This is an important distinction. It is not unusual to find a manager excited about how cheap his or her portfolio is, despite the asset class not being anywhere near as cheap.

UK equities are a classic example of a region where we are able to find exciting funds, despite not being terribly excited about the market. Why are we finding so many good fund managers in the UK who are particularly excited about their funds, this late into a bull market?

The team spend a lot of time meeting managers and researching asset classes. Being based in the UK, it is no surprise that we meet a lot of UK equity fund managers, given the culture of equity investing and the many savings institutions that enable it. In the IA UK All Companies sector alone, there are 244 funds. In the IA Japan sector there are 72 funds, yet Japan is nearly double the weight of the UK in the MSCI World index. So the first factor to consider is the law of large numbers: meet enough managers, and eventually you’ll find a good handful saying what you want to hear.

The second factor is talent pool. Do UK equity funds simply attract lots of talent, so that the proportion of good managers in the IA UK sectors is simply higher than in others? There is undoubtedly something to this. Many investors in the UK suffer from “home market bias” – the tendency to over-allocate to your home market just because it is familiar to you. Hence it follows that talent will gravitate to managing funds where there is a greater likelihood of raising assets.

Finally, there is the “opportunity set” factor. This comes down to ‘how cheap is the market?’ Valuation is the number one consideration we take into account when making an investment. We need a margin of safety on our side. We run diversified portfolios, and we’re going to get it wrong some of the time, and when we do, we’d like to minimise the downside via valuation support. When comparing regional equity markets, first we adjust for sector composition. A market with a higher weighting to technology “should” be more expensive than one with a higher weighting to banks. Then we look at the price of that market today, and divide it by cyclically adjusted earnings (e.g. a 10 year average) on the basis that one year’s earnings carries very little information.

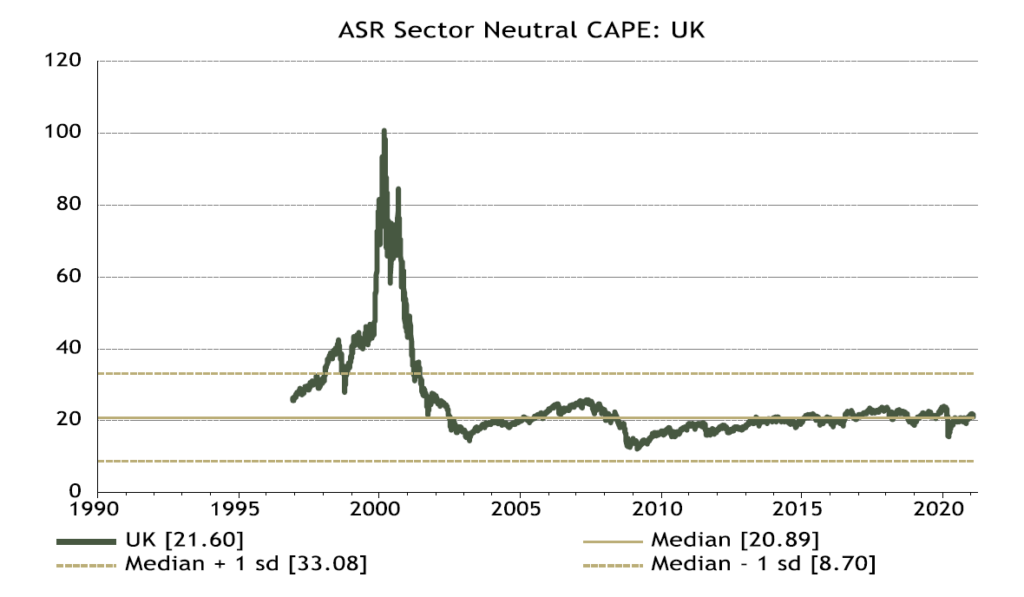

The UK market looks like this through time on this measure:

Source: Absolute Strategy Research, October 2020.

Ignoring the distortion from 2000, it does not look particularly cheap. This shouldn’t be surprising. The UK does not have the large weighting to the large cap glamour stocks that the US does, but it is still up significantly since the trough of the Global Financial Crisis.

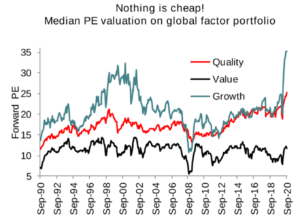

As a very quick tangent, the UK is often seen as a “value” market in the growth vs value debate. Here’s a great chart from Societe Generale putting this into context.

Source: Societe Generale, September 2020.

Value as a style is clearly cheap versus growth, but relative to its own history, it isn’t cheap at all. Again, this should not be a surprise after more than 10 years of rising stock prices.

But back to the UK. It is true that the UK market is cheap relative to the US, but it isn’t particularly cheap in aggregate on its own.

On the other hand, if there is a high dispersion of valuation in the UK, the lack of cheapness in aggregate may not matter too much. Combine that dispersion with highly talented managers who can take advantage of it, and you begin to resolve the conflicting messages.

We are particularly excited about smaller funds like GVQ UK Focus, Teviot UK Smaller Companies, Odyssean Investment Trust and Gresham House UK Multi Cap Income, which we mix with larger funds like Polar Capital UK Value Opportunities or Man GLG Income.

Picking on one fund, the managers of GVQ UK Focus have put together a portfolio of companies from which they expect to generate a 35%-ish IRR over the next 3 years. They have barely any exposure to the highly cyclical (and large) banking and commodity sectors. They have no exposure to high growth no-earnings tech stocks. It’s simply a balanced portfolio of stocks picked without regard to the composition of the index. The fund’s prospective yield is above 4%. The other thing you will notice is the fund was -25% last year.

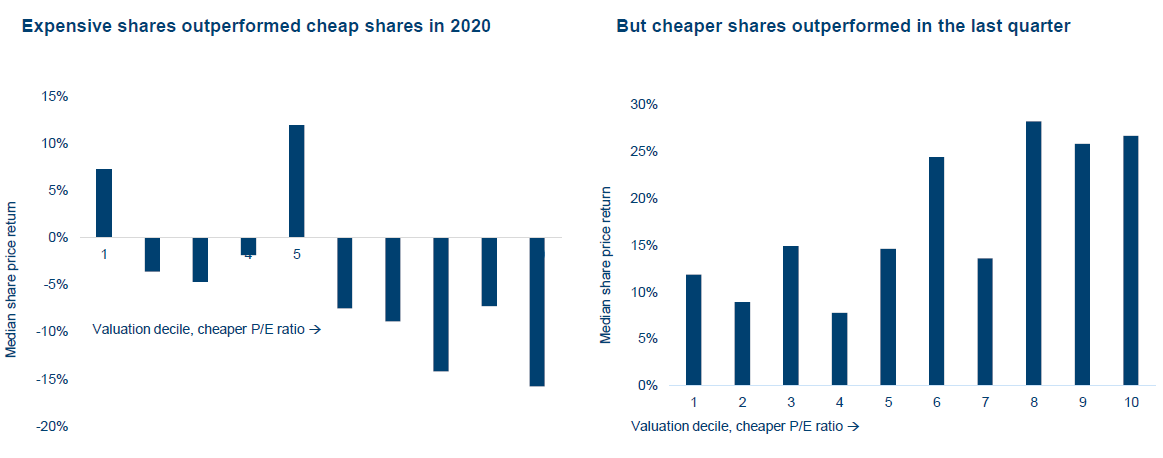

When you look at the Hawksmoor Funds, you won’t always find them populated with the top performers of the day. Often, those sorts of funds are likely to be holding stocks that are far too expensive to offer us a sufficient margin of safety. Hence why we can be drawn to last year’s losers. GVQ’s longer-term track record suggests that when they are “on form”, they deliver exceptional relative and absolute performance. Many of the UK funds we own fall into this category. Indeed the following from Polar Capital suggests that valuations may be starting to matter again in the UK, which will really help our Funds:

Source: Polar Capital, February 2021, data as of Q4 2020.

But do not mistake an increase in our exposure to these funds as an asset allocation call to UK equities. In this case, it’s far more nuanced.

Ben Conway – Head of Fund Management

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA4254.