Our final thought for last week was that the UK’s medical advice and Lockdown 2 had placed the COVID ball firmly in the courts of Messrs Sunak and Bailey. In a near perfect segway, this morning we are going to look at whether they have duly returned serve, or if, Murrayesque, they have fluffed the ball into the net.

Let us start with the Chancellor. I confess that it took time for the penny to drop with me. Listening to the the Job Support Scheme announcement was, in the wonderful words of Denis Healey, like being savaged by a dead sheep. That, though, is precisely the point. The JSS, as we shall call it (moving on from the CJRS) is meant to underwhelm.

It is not being overly harsh to say that the current government is prone to quite rapid and random changes of policy. C’est la vie, as we will not be allowed to say come 2021. However, and this is a big however, last week’s change of tack is the most important since March. COVID financial policy thus far has been a matter of promising to hand out money willy-nilly. But no more.

Sunak’s message was very skilfully delivered, but stark. It is that the government will no longer support zombie businesses and non-jobs. Instead, the economy must man up and get on with it. COVID has changed the world and the government will no longer write blank cheques to pretend otherwise.

Gosh. And gosh again. By gum. Stone the crows. You could knock me down with a feather. Goodness gracious. Pull the other one. Crumbs. Come again?

This matters. If we mix Lockdown 2 with the JSS, we are in for a longer and bleaker winter than very many had thought. Knowing the speed with which things happen, all this may look very different in a week’s time, but as at today, this is a hugely significant change. It is a watershed.

It is a change for worse, and for better. The prognosis for the social industries – mainly leisure, hospitality and entertainment – is not appetizing. The other edge to the sword, however, is that 2021’s prospects start to look brighter. The economy has to adapt and move on. We have written several times about the importance of ‘transition’: the need for business to embrace the twin realities of decarbonization and COVID. Sunak has just made this policy.

The Chancellor, though, has hopefully only shown half his hand. Effective transition will need help and leadership. But if the government can find ways to kick start the process (funding can come in many ways other than blank cheques), the economy will rapidly develop businesses and jobs shaped for the COVID and decarbonized age.

This is a line of thinking that was very clearly understood by the previous Governor of the Bank of England. It is less clear that the incumbent is like-minded. One of the most disappointing items of news last week was that the Bank has failed to attach any environmental criteria to its funding. It has what is likely to be a one-off opportunity to link climate change (which, remember, is the greatest systemic risk to financial stability) to its lending and bond buying. Last week the Bank admitted that it has not really given this too much thought, but now that it has been mentioned it might not be too bad an idea.

Oh dear. Mr Bailey’s bad week regrettably did not stop there. He continues to lay the ground for negative interest rates. In our view, negative rates will cause more harm than good. Our economy needs the high street banks to provide finance, to both companies and individuals. To do this efficiently and effectively (always a challenge for a bank), they need to be profitable. The easiest way for a bank to earn a profit is unsurprisingly to lend money at higher interest rates than it pays on deposits. And the higher the rates are, the easier it is to have a profitable margin between the two. With negative rates, not only does the reverse of this hold true, but also customers are being forced to take their money out of the bank. So the banks both shrink and also have to find more expensive funding elsewhere. Double whammy. Negative rates will, in our view, shrink the banks, shrink the economy and lower confidence even further. Triple whammy. That is a massively simplified argument, of course, but no less true for it.

Well done to those who spotted last week’s reference to Listerine’s Clifford. Today, what is unique about the royalties from Abba’s Chiquitita?

One final plug for our workshop on Wednesday on Successfully Navigating ESG. This is proving very popular and anyone not yet signed up should please contact Jill as soon as possible.

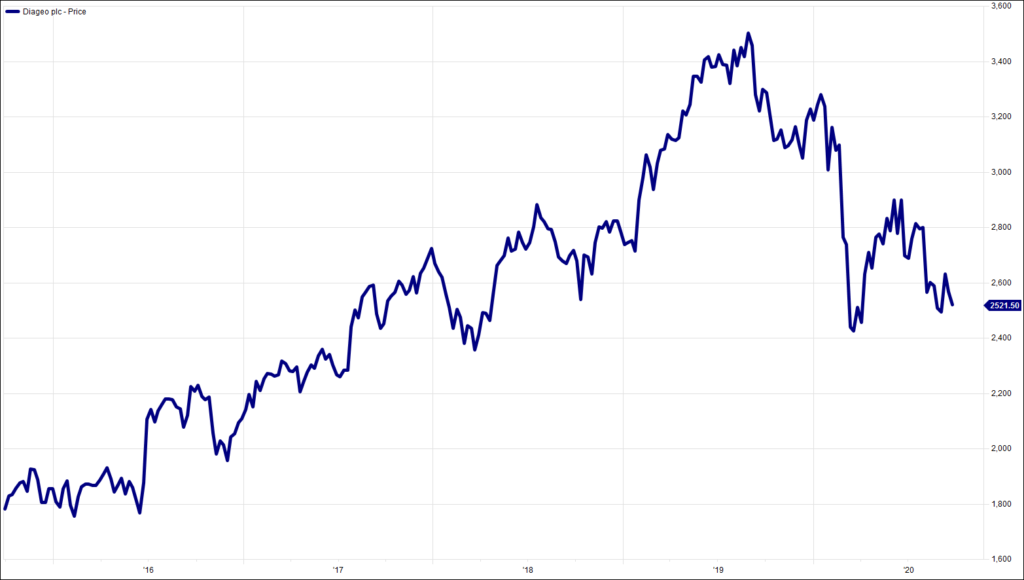

Chart of the Week:

Diageo, past 5 years.

HA804/273

All charts and data sourced from FactSet

Jim Wood-Smith – CIO Private Clients & Head of Research

Hawksmoor Investment Management Limited is authorised and regulated by the Financial Conduct Authority (www.fca.org.uk) with its registered office at 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. This document does not constitute an offer or invitation to any person in respect of the securities or funds described, nor should its content be interpreted as investment or tax advice for which you should consult your independent financial adviser and or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. The editorial content is the personal opinion of Jim Wood-Smith, CIO Private Clients and Head of Research. Other opinions expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represent the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. Currency exchange rates may affect the value of investments.