Part 1 – Why are Discounts Currently Wide and Why Does it Matter?

29th June 2023

Addressing persistent investment trust discounts is vital not just for the health of the sector, but also for the whole UK economy, with responsibility falling on all stakeholders; investment company directors, investment advisors, brokers and all shareholders, both institutional and retail.

When discussing discounts, a clear differentiation needs to be made between investment trusts that own liquid assets, i.e. equities, and compete with open-ended funds and those that own fewer liquid assets i.e. smaller company equities, loans, alternative assets etc. With the former group, we believe the discount is a choice. It is clearly in the power of boards to undertake some form of corporate event which might include liquidating part or all of the portfolio to buy back shares or to return cash to shareholders. Shareholders and boards simply should not tolerate persistent discounts in those trusts. On the latter group, the discount is a reflection of multifarious factors that may be outside the board’s control. In any case, across all trusts where a discount is persistent, potential solutions are not possible without the board’s recognition.

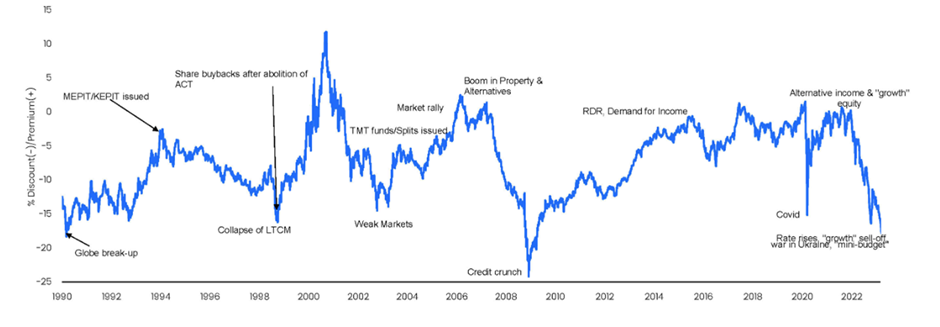

Illustrated by the below chart from Numis this year, the investment companies’ sector is trading at close to the widest discount in history.

Source: Numis 30/04/2023.

Historically, investment trust discounts have broadly correlated with stock markets with discounts widening in ‘risk-off’ periods. However, the current historically wide discount is at odds with that past-experience for a number of reasons, some of which are laid out below:

1) The great re-pricing of fixed income and debt.

The composition of the investment trust sector has changed markedly with new issuance over the past decade dominated by alternative asset classes, that represent around 50% of the sector, many of which have income focussed return targets. In a world of rock-bottom risk-free rates, the relative yield attractions of alternative income trusts saw many trade on persistent premia. The 2022 step change in the returns available from vanilla fixed income has, however, seen these premiums turn into discounts as investors move to price these alternative income trusts on a yield basis relative to competing assets. With many alternative investment trusts applying leverage, higher interest rates also impact via the channel of higher debt costs whilst forward NAV expectations are also susceptible given the opaque discounted cash flow valuation methodology employed by many. With that 50% of the sector represented by alternatives, their NAVs are calculated using a variety of methodologies, usually by an independent valuer and report to the market on a quarterly or six-monthly basis. There will therefore be occasions when the discounts are still reflecting the old NAV, and that has certainly been the case for much of 2023 so far.

2) Negative sentiment towards particular asset classes.

For example, sentiment towards ‘growth capital’ trusts has reversed with these former darlings of the sector now deeply unloved today. The largest investment company, Scottish Mortgage has been at the epicentre of this shift moving from a premium in November 2021 to a 20% discount today as a result of the changing macro and interest rate environment.

3) An over-supply of trusts in particular sectors.

There are simply too many trusts doing the same thing. For example, one large asset manager has four Asia Pacific trusts, with each of them trading on double-digit discounts. While they each have an independent board of directors and will have slightly different objectives, this neatly illustrates the over-supply issue. Too much supply combined with often poor liquidity means too many trusts lack relevance, particularly in the context of vanilla equity trusts where many closed-ended mandates could just as easily be managed within a daily dealing open-ended fund. In addition, the externally managed structure can be a barrier to consolidation (with some boards perhaps not wishing to lose their jobs, or the management contract putting off potential acquirers).

4) Structural headwinds around fees.

The Investment Association’s recent guidance for all funds in the IA sectors, to disclose investment companies’ ‘costs’ within their own OCFs has, despite good intentions, provided a disincentive to invest in them. That compounds the wealth management community’s aversion to the sector partly because of the requirement to disclose these costs since MIFID. There can be no doubt that a significant portion of the UK’s investor base now no longer invests in the sector or is currently actively disinvesting.

5) Wealth management consolidation.

Ever larger wealth and asset managers demand scale and liquidity meaning their market cap threshold for investing in investment trusts has got higher and higher over the years, thus reducing the number of eligible trusts in their universe.

6) Weak corporate governance and shareholder inertia.

A long-argued advantage investment trusts have over their open-ended equivalents is the presence of an independent board of directors whose job it is to prioritise the interests of shareholders over the interests of the investment advisor. There is plenty of anecdotal evidence where those priorities have been the wrong way round, but the presence of these persistent discounts is, in our opinion, hard evidence of sub-standard corporate governance within the sector over recent years. The inability or unwillingness of all shareholders to engage and hold Directors’ feet to the fire has compounded the issue.

Why discounts matter?

In the past, wide discounts have, to a degree, been self-correcting with the powerful combination of a rising NAV and narrowing discount attracting new buyers. Confidence in this dynamic playing out going forward is however, undermined for all of the reasons outlined above with important implications for the sector, investors and broader economy alike:

- The long-standing accepted process of investment trust IPOs is that shareholders pay a 2% premium on day one, reflecting the costs involved in setting it up. We will talk about the IPO process later in this series and how it needs to change, but that derating from a premium to discount is painful and off-putting for day-one investors.

- Discount volatility is often cited as a reason to not invest in investment trusts. Investors in trusts, particularly those alternative asset classes that promote an uncorrelated return to equities and bonds, need comfort that the shareholder total return will closely track that of the net asset value.

- A key attraction of being a listed company, rather than a private fund, is access to growth capital. As all equity issuances should be done at a premium, investment trusts trading on a discount cannot raise capital. The window for IPOs and secondary raises also closes when the whole sector or peer group is trading on a discount.

- Renewable energy and infrastructure trusts comprise a material part of the sector and, beyond their importance to the UK stock market, they are also important for the UK economy. The example we often give on this subject is the battery energy storage trusts which own approximately 40% of all energy storage projects in the UK today. Without these investment companies launching over recent years and raising significant amounts of money in subsequent secondary placings, the renewable infrastructure industry would be constrained in meeting the UK’s energy transition targets.

The difficulty in assessing why discounts are currently so wide is the inability to scientifically disaggregate the various causative factors. We believe there is a real danger of complacency. Many boards are too reliant on sentiment or cyclical factors to explain away the discount on their trusts. Some of the factors we point out above are new and structural in nature. It is time to face up to these issues and do something about them.

Over the coming weeks we go into some of the points raised here in more detail. Next week we review the investment trust IPO process.

From left to right: Ben Mackie, Ben Conway, Daniel Lockyer, Dan Cartridge

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC1119.