December 2019

In managing the three Hawksmoor Funds we are guided by the simple and overriding objective of growing the value of our client’s wealth over time, once adjusted for inflation and all costs. In this regard 2019 has been a good year with our more cautious Vanbrugh Fund delivering a nominal net return of 9.8%, which is broadly in line with its annualised return since launch. The Distribution and Global Opportunities Funds returned 11.0% and 16.4% respectively.

In constructing portfolios we are entirely benchmark agnostic and are not influenced by how peers are positioned as we don’t believe either would help in achieving the core goal described above. We are aware however, that some of our investors will compare our Fund’s performance with that of other multi-asset funds and recognise that 2019 in relative terms was difficult, with both Vanbrugh and Distribution finishing the year in the bottom quartile of their respective IA sectors. The turning of a New Year often inspires a little retrospection and as such this article seeks to explain some of the factors behind the underperformance and why we retain conviction in our current portfolio positioning.

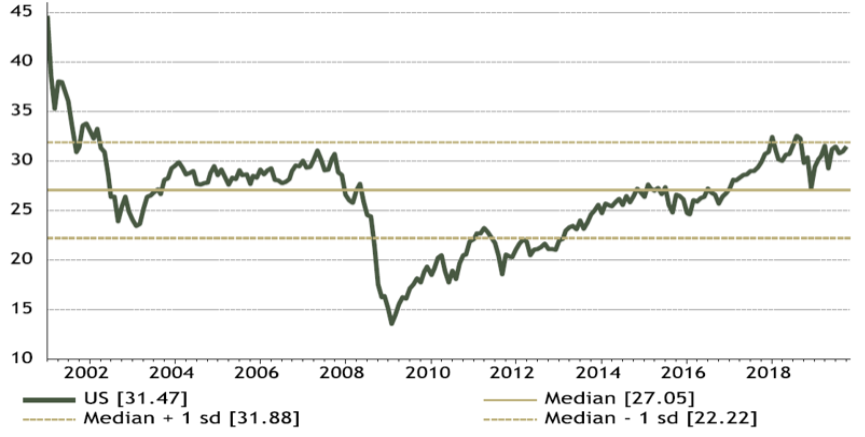

2019 was a remarkable year for global financial markets with practically all major asset classes delivering positive returns. The Morningstar US Market index of US equities, for example, was up 26% in sterling terms, an outsized return in any year but all the more incredible given the maturity of the market cycle and elevated starting valuations. US equities look expensive on a host of metrics with one of our favoured measures (the sector neutral cyclically adjusted price earnings ratio) trading well above its long run average. In the face of deteriorating expectations for corporate earnings growth, the anatomy of the US equity rally is troubling with 2019 returns almost exclusively driven by multiple expansion.

Fig1: ASR sector neutral cyclically adjusted price earnings ratio (current market price divided by the average of the past ten years of earnings, adjusted for inflation)

Source: Absolute Return Strategy, 04/11/2019

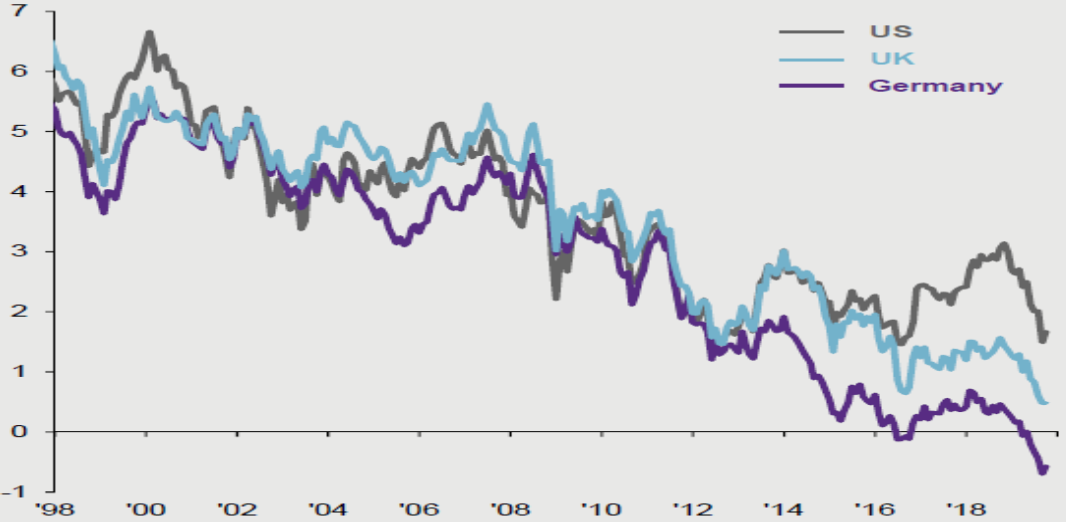

Elsewhere, investors in lower risk 10 year UK government debt netted a healthy total return of 7.5% despite the bond offering a paltry yield of just 1.2% at the start of 2019. Even more incredible were the huge swathes of the global bond market which ended the year trading with negative nominal yields, a development symptomatic of the distorting effects of unconventional and highly accommodative monetary policy from the world’s central banks.

Fig2: US, German & UK nominal 10 year government bond yields grinding lower and close to historic lows

Source: JPM Guide to the Markets, 30/09/2019

2019 it seems then, was a year when fundamentals did not matter. The valuations of already expensive US growth stocks became even more demanding and the already painfully low gross redemption yields offered by high quality bonds headed further south. In the context of our valuation driven process, this proved to be a difficult environment for us. Whilst not complacent about underperforming the peer group we have, however, been vehement in ensuring that we stick to our investment principles and that we adhere to our disciplined approach of constructing well diversified portfolios of cheap assets that possess a margin of safety. We accept that valuation is a poor market timing tool but also retain conviction that it is the most important determinant of future long term returns and similarly believe that the best way of reducing the probability of a permanent loss of capital is to avoid overpaying for an asset. These core beliefs combined with our unconstrained approach to asset allocation mean we have refused to chase unequivocally expensive assets, resulting in minimal exposure to US equities and long duration bonds which in 2019 led markets higher. Avoiding these types of assets contributed to short term underperformance but owning them would, to our mind, expose our investors to unacceptable risks.

As a result of our process, our portfolios will often look very different to the peer group and this is especially true at mature stages of the cycle when valuations tend to become extended. We are happy to leave some parties early, especially when there are more interesting, less crowded places to go. Within major markets we have been able to identify some pockets of value and have targeted allocations to UK, Japanese and emerging market equities as well as emerging market debt. Overall however, exposure to traditional equities and bond markets is almost as low as it has ever been in the Funds’ history. The corollary of this is a higher allocation to more idiosyncratic risk and investments that exhibit limited correlation to mainstream financial markets. These include investment trusts investing in private equity, direct loans, ships, song royalties and niche areas of the property market. Most of these investments have performed admirably but on the whole have inevitably failed to keep up with exuberant equity markets.

Both Vanbrugh and Distribution exhibit significantly lower volatility than their sector averages and historically have tended to outperform peers on the downside, owing in large part to our margin of safety focused process and the highly diversified nature of the portfolios we construct. 2019 was no different with Vanbrugh in particular, delivering positive relative returns (versus its IA sector) during the rapid equity market sell-off of the late summer. Pleasingly the funds also did well in the final quarter of the year, a period in which general markets delivered positive returns, with the allocation to cheap UK equities and Real Estate Investment Trusts, which re-rated in the aftermath of the general election, driving outperformance.

Should the ‘melt-up’ in markets persist we will stick to our principles and it is likely that we will endure another period of relative underperformance. Equally we would expect to deliver good risk adjusted absolute returns in such an environment. Exactly what happens over the course of the coming year is impossible to say, but we do observe that the cycle is mature and that heightened economic and political risks do not appear to be reflected in the prices of many assets. Against this backdrop our more cautious positioning seems prudent and we are sure that one day valuations will matter again. In the meantime we remain enthused by the opportunity offered by many of our more idiosyncratic investments and continue to adopt a highly selective approach to mainstream equity and bond markets.

Source: Fund and Index performance from FE Analytics. 31/12/2018 to 31/12/2019. 10 year UK Government return from Alpha Terminal, 31/12/2018 to 31/12/2019.

Ben Mackie – Fund Manager

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation. They are subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA3632